US Dollar, Mexican Peso, US-Mexico Trading Relations, Understanding the Core-Perimeter Model – TALKING POINTS

- How to trade the Mexican Peso against the US Dollar

- What is the US-Mexico trading relationship and why does it matter for USD/MXN?

- How the relationship between the US and Mexico fits into the Core-Perimeter model

How The United States-Mexico Relationship Impacts USD/MXN

The United States and Mexico have a close economic relationship that is underpinned by their geographical proximity. Cross-border regional trade agreements like NAFTA– now replaced by the USCMA – reinforce their inter-connectedness. However, the disparity in economic development between the core (US) and perimeter (Mexico) creates an asymmetric relationship.

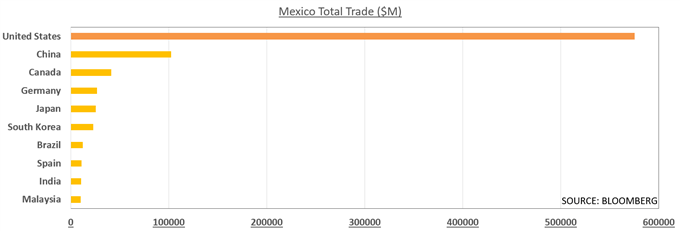

The US economy is the world’s largest economy and is overwhelmingly consumer-driven, making it is less vulnerable to the ups and downs of the global business cycle than an export-oriented one like Mexico. Furthermore, the latter’s growth trajectory is in large part predicated on robust demand from the former. Indeed, the US accounts for approximately 86% of Mexico’s cross-border sales.

Mexico Trade With US Dwarfs Total Trading Volume With Other Partners (2018)

Source: Bloomberg

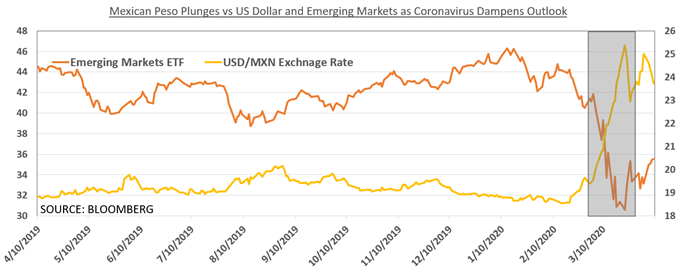

Therefore, if the economic outlook for the US is optimistic and demand for Mexican goods consequently rises, an expected rise in volume of trade leads capital to flow from core to perimeter. This is amplified by money from investors looking for the cyclicality of Mexican Peso-denominated assets to offer outsized returns against an upbeat backdrop.

In this environment, the USD/MXN exchange rate typically weakens. That dynamic is magnified by higher risk tolerance among investors, who might not be as willing to hold onto cycle-sensitive assets in economically unstable conditions.

If there is a disruption in economic growth, the flow of capital typically reverses. The result is a stronger USD/MXM exchange rate as investors divest of riskier assets in the perimeter (Mexico) to park their capital in comparatively-safer vessels in the core (US). Here, abundant liquidity dulls volatility amid market turmoil.

Even if the growth-disrupting catalyst originates in the United States, traders seem to prefer US Treasury bonds and the Dollar over their Mexican equivalents. To put it another way: capital still gravitates from perimeter to core.

Read more on the top 5 emerging market currencies and how to trade them.

Key Takeaways on How to Trade USD/MXN:

- When the growth outlook is positive and risk appetite is high, capital frequently flows out of the core (US) and into the perimeter (Mexico)

- This dynamic reverses if economic activity in the core is disrupted, putting the growth trajectory of the perimeter in jeopardy

- The Pesois strongly influenced by the US business cycle because of the heft of the world’s largest economy and its geographical proximity to Mexico

MORE MACRO FOREX TRADING GUIDES IN THIS SERIES

- Relationship Between Core and Perimeter Countries

- China-ASEAN Relations and How it Influences SGD, IDR, MYR, PHP

- How US-Canada Trade Relations Impact CAD and USD

- China-New Zealand and Australia Relations: Trading AUD & NZD

- How US-Mexico Relations Influence the Mexican Peso and US Dollar

--- Written by Thomas Westwater, Contributor for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

https://www.dailyfx.com/forex/fundamental/article/special_report/2020/06/16/Mexican-Peso-Outlook-at-the-Mercy-of-US-Economic-Trends.html