Singapore Dollar, Malaysian Ringgit, Indonesian Rupiah, Philippine Peso – Talking Points

- US Dollar fell as upbeat sentiment slowed emerging market capital outflows

- Focus for markets may shift from stimulus bets to key US economic data next

- Will USD/SGD, USD/MYR, USD/IDR and USD/PHP move on local PMI data?

US Dollar ASEAN Weekly Recap

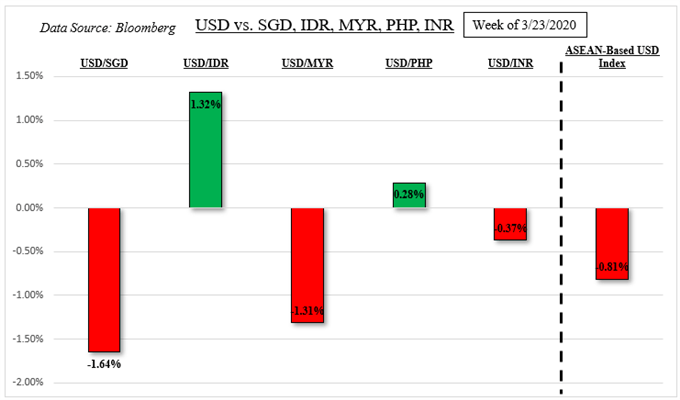

The US Dollar retreated against the Singapore Dollar and Malaysian Ringgit while gaining cautious ground against the Indonesian Rupiah last week. The passage of a US$2 trillion fiscal package from the world’s largest economy amid the coronavirus outbreak improved market sentiment. Wall Street soared, resulting in the best 5-day performance in over a decade which undermined the necessity for the haven-linked US Dollar.

ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/IDR

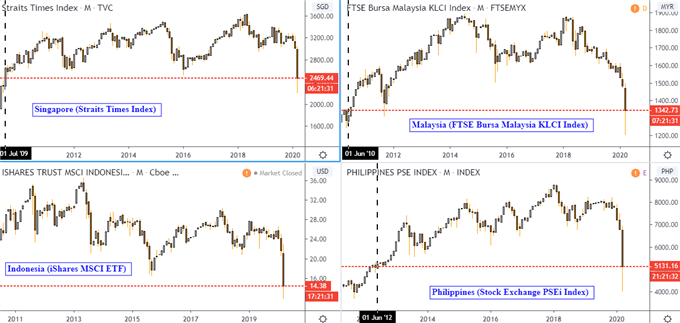

Gains in equities from developed economies echoed into developing ones. Indexes tracking shares from ASEAN nations such as Singapore, Malaysia, Indonesia and the Philippines trimmed losses on the monthly charts below. This resulted in lower shadows forming. With that said, these are still on pace for their worst average monthly performance since the 2008 financial crisis.

ASEAN Stocks Trimmed Losses Last Week

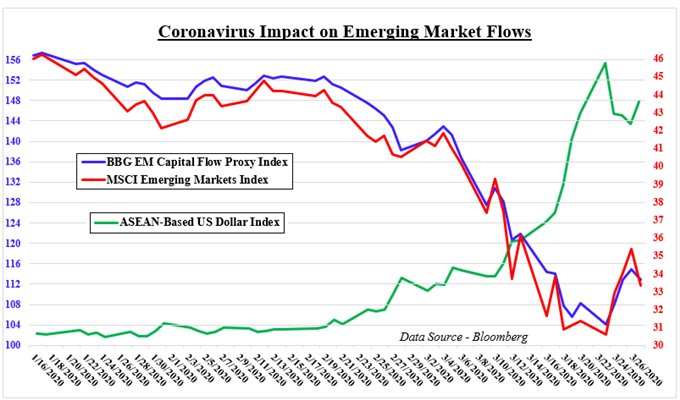

Emerging Market Capital Outflows Partially Recovered

As expected, emerging market capital flows were and arguably remain a key factor for the trajectory of USD/SGD, USD/MYR, USD/IDR and USD/PHP ahead. On the next chart below, my ASEAN-based US Dollar index declined last week as the MSCI Emerging Markets Index (EEM) rose alongside a proxy tracking the flow of capital around developing economies.

The Singapore Dollar also received a boost after the local government announced additional fiscal stimulus measures. On Monday, USD/SGD spiked lower briefly after the Monetary Authority of Singapore (MAS) reduced the slope of its currency band to zero. No changes were made to the width of the band as the MAS envisioned the economy entering a recession this year with great certainty.

Event Risk This Week – US Data and ASEAN Manufacturing PMIs

US Speaker of the House Nancy Pelosi hinted that a further bipartisan fiscal stimulus package may not be on the table until after the Easter holiday. With that in mind, the focus for market mood may start shifting to economic data outcomes from the world’s largest economy. These will continue to offer a better insight into the damage social isolation is having on growth.

On this front the US Dollar could rally if local ISM PMI, jobless claims and non-farm payrolls disappoint relative to economists’ expectations. That may induce a “risk-off” tilt that reignites demand for the highly-liquid US Dollar. This may also rekindle investors’ unwinding of relatively riskier exposure. That could see emerging market capital outflows resuming course as the flight for safety boosts government bond prices.

Official gauges of Chinese business activity – both manufacturing and non-manufacturing – showed a sharp rebound in March after record losses. That helped fuel an optimistic tone in sentiment relatively early into this week’s session. Yet officials warned that it does not necessarily mean that the world’s second-largest economy is back to normal.

On Wednesday Malaysian, Indonesian and Philippine Markit manufacturing PMI data will cross the wires. Similar data from Singapore is due on Friday. Yet their respective currencies may look past local developments for broader themes discussed in this week’s ASEAN fundamental outlook. The upbeat mood this week thus far risks sending USD/SGD, USD/IDR, USD/PHP and USD/MYR on average to the downside.

-- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter