CRUDE OIL, OPEC, RUSSIA, CHINA, YEN, S&P 500 - TALKING POINTS:

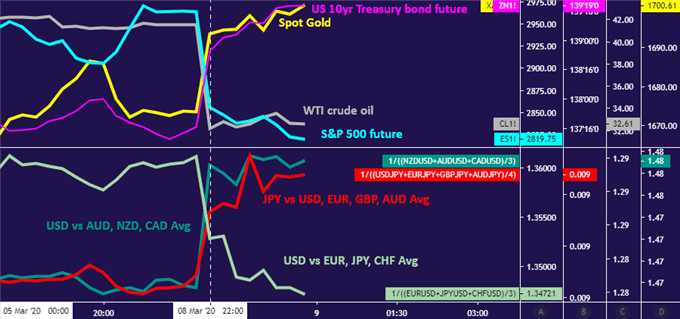

- Yen leads Euro, Franc higher as sweeping liquidation strikes markets

- China posts dismal trade data, OPEC+ crude oil output cuts unravel

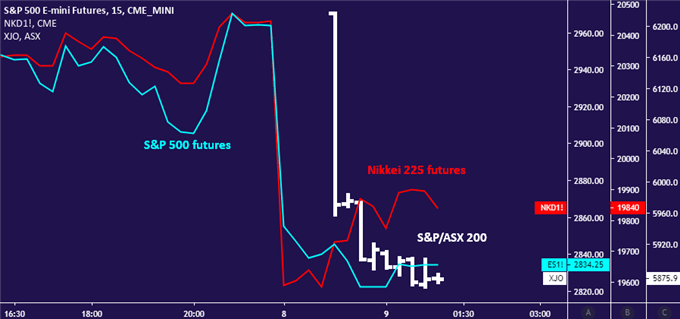

- S&P 500 futures trade limit-down, Treasury yields probe record lows

The Japanese Yen outperformed while financial markets swooned as crude oil prices crashed after OPEC and Russia failed to reach a deal prolonging their output cap scheme. The cartel and a group of like-minded producers – dubbed “OPEC+” – have been coordinating to hold back capacity, restrict supply and boost prices since 2016. Riyadh wanted to keep going as the coronavirus threatens demand. Moscow did not.

Abysmal trade data from China has compounded the dour mood. The world’s second-largest economy posted the largest trade deficit in 16 years in February. Exports fell 17.2 percent on-year, marking the biggest drop in four years. The decline in imports was more modest at 4 percent. Nevertheless, this marked the 14th consecutive month of contraction, which bodes ill for countries reliant on Chinese demand.

Currencies attached to central banks that have relatively little scope to lower borrowing costs followed the Yen higher. The Swiss Franc and Euro – where the SNB and ECB have already brought policy rates into negative territory – outpaced gains in the British Pound, where there remains room for 75 basis points in cuts. Alternatives with greater room for easing – AUD and NZD – declined. The frequently oil-linked Canadian Dollar proved weakest of the pack however.

Chart created with TradingView

The US Dollar put in a mixed performance, rallying against cycle-sensitive and positively-yielding currencies while falling against the anti-risk side of the spectrum. The Fed is widely expected to cut rates again later this month after a surprise 50bp reduction last week amid market turmoil, narrowing USD’s yield advantage against the likes of the EUR and JPY. Its liquidity haven appeal is countervailing force however.

Gold prices rose as safety-seeking capital flows sent US Treasury bonds higher, pulling down yields. That burnished the appeal of non-interest-bearing alternatives epitomized by the yellow metal. The return on the benchmark 10-year note probed below 0.5 percent while the cost of 30-year borrowing ticked below 1 percentfor the first time on record.

Chart created with TradingView

Stocks plunged in Asia-Pacific trade, with Japan’s Nikkei 225 and Australia’s S&P/ASX 200 suffering steep losses. Looking ahead, a steep drop in futures tracking the bellwether S&P 500 index plummeted to trade limit-down, activating a cap on losses at 5 percent. That appears to set the stage for continued liquidation in the hours ahead.

TRADING RESOURCES

- Just getting started? See our beginners’ guide for traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter