EUR/USD, USD/CAD, USD/JPY, US Dollar, IG Client Sentiment - Talking Points

- US Dollar holding fairly steady despite aggressive easing from the Fed

- Trader bets favor EUR/USD upside, USD/CAD & USD/JPY downside

- EUR/USD, USD/CAD technical picture points higher. USD/JPY lower

How Can Trader Positioning Impact the Outlook for the US Dollar?

In this week’s session, I covered a broad sweep of the US Dollar and what the outlook could be in EUR/USD, USD/CAD and USD/JPY using IG Client Sentiment. This follows an emergency Fed 50-bp rate cut to support local growth amid the coronavirus outbreak ahead of the Bank of Canada later today. Lately, the haven-linked US Dollar has been stalling, but what can trader positioning reveal about the path forward from here?

EUR/USD Sentiment Outlook

According to IGCS at the time of recording, about 35.41% of EUR/USD traders were net long. This followed a 60.87% rise in short bets from last week, speaking to a greater share of investors attempting to pick the top in the currency pair. Traders are further netshort than yesterday and last week, and the combination of current sentiment and recent changes offers a stronger EUR/USD-bullish contrarian trading bias

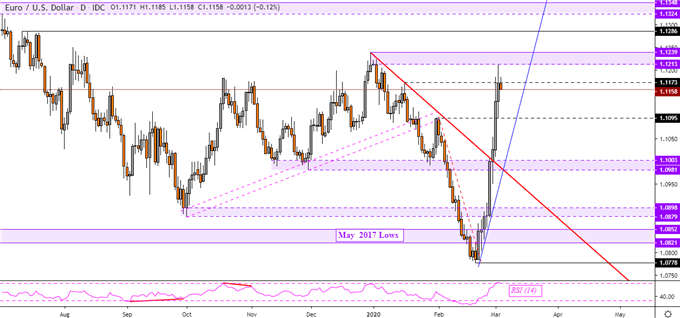

EUR/USD Technical Analysis

From a technical standpoint, EUR/USD remains in an aggressive short-term uptrend from the end of February. This followed a push above key falling resistance from December. Resuming gains entails taking out peaks from the end of last year. That places resistance as the psychological barrier between 1.1213 to 1.1239. Taking out the latter exposes highs from July.

EUR/USD Daily Chart

EUR/USD Chart Created in Trading View

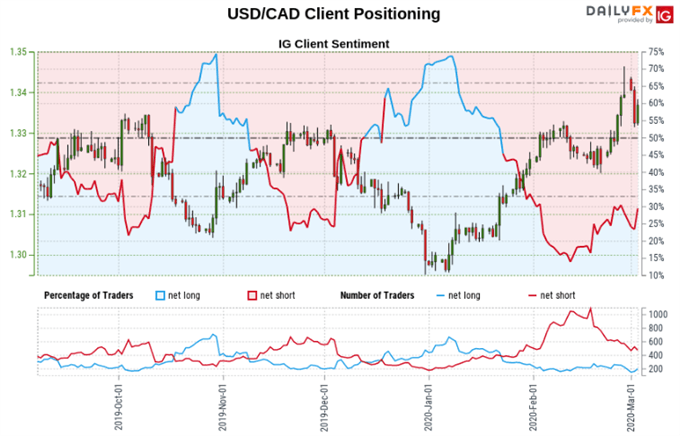

USD/CAD Sentiment Outlook

At the time of this writing, about 32% of USD/CAD traders were net long. This is down from a roughly 74% upside bias since January when the currency pair found a bottom. However, recent changes in positioning are hinting that USD/CAD could turn lower. That would speak to a greater share of traders starting to pick the bottom in the event prices decline in the near-term.

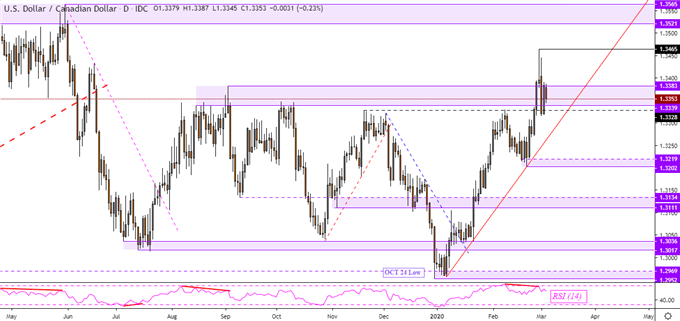

USD/CAD Technical Analysis

USD/CAD struggled to maintain a push above key resistance which is the psychological barrier between 1.339 to 1.3383. Yet, the uptrend from the beginning of this year is being maintained by rising support – red line on the chart below. In the event of a turn lower, as forecasted in IGCS, this trend line may stem a selloff. A further daily close under 1.3202 may shift the near-term technical bias to the downside.

USD/CAD Daily Chart

USD/CAD Chart Created in Trading View

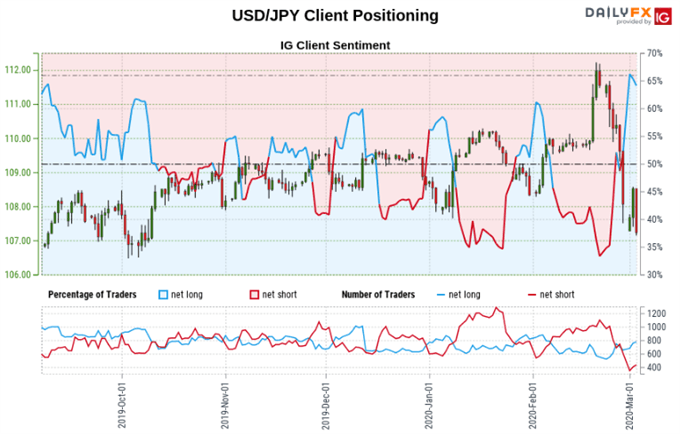

USD/JPY Sentiment Outlook

According to IGCS, about 63% of USD/JPY traders are net long. This is a material uptake from just under a 35% upside bias in late February. Since then, prices have declined over 4.2% as a larger share of investors attempted to pick the turning point in the pair’s downtrend. From here, the IGCS outlook remains bearish given recent changes over a day-to-day and week-to-week basis.

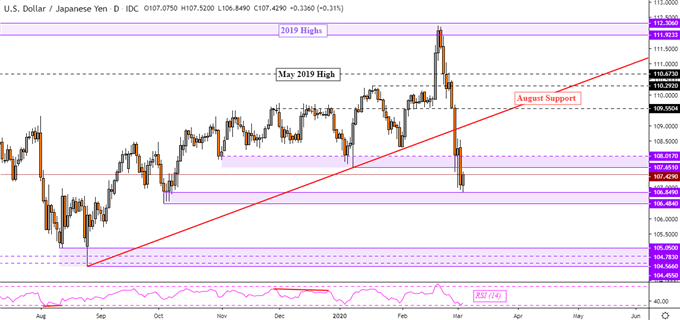

USD/JPY Technical Analysis

From a technical standpoint, the USD/JPY outlook remains bearish. Prices managed to confirm a downside breakout through key rising support from August. Resuming the downtrend entails taking out lows from October which form a barrier of support between 106.48 to 106.84. Taking out the latter would then expose 2019 lows.

USD/JPY Daily Chart

USD/JPY Chart Created in Trading View

*IG Client Sentiment Charts and Positioning Data Used from March 3 Report

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter