AUD/USD, S&P/ASX 200, RBA – Talking Points:

- AUD/USD down with Aussie yields but ASX 200 resilient in risk-off trade

- Aussie Dollar unable to capitalize as US-Iran conflict appears to cool off

- Rising RBA rate cut bets signal worries about Australian economic health

The Australian Dollar traded true to its typical pro-risk profile as tensions between the US and Iran exploded, dropping alongside the standard set of cycle-sensitive assets like the S&P 500. Go-to defensive plays – Treasury bonds, gold and the Japanese Yen – dutifully declined.

The defensive mood understandably drove yields lower as capital fled to the perceived safety of government debt and investors pondered the possibility that negative knock-on effects form the turmoil will spur central banks to boost stimulus.

That did little to help most global equities. The MSCI World Stock index suffered the largest drop in a month as the US killed IRGC Quds Force commander Qassim Soleimani. It then dipped to a one-month low as Iran responded with rocket fire on a US base in Iraq, before talk of de-escalation inspired a rebound.

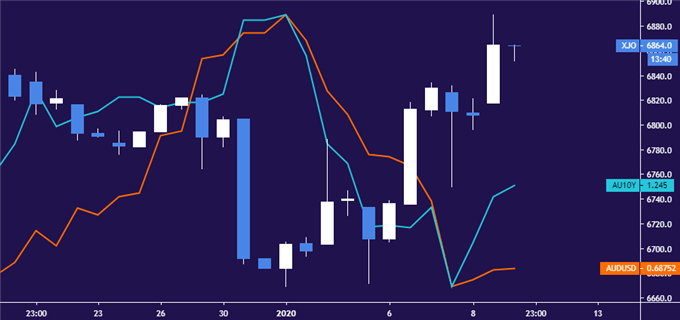

Australia’s S&P/ASX 200 stock index marked a curious exception. It rose even as AUD/USD plunged alongside local 10-year bond yields. More curious still, the recovery in risk appetite in the second act of the US-Iran drama did not appear supportive for the Aussie Dollar or local borrowing costs.

AUD/USD, ASX 200 chart created with TradingView

The probability of an RBA rate cut when policymakers convene for a decision next month rose from 38 to 56 percent since the start of the year. The idiosyncratic performance from bellwether Australian assets suggest this may be about more than just geopolitically-inspired swings in risk appetite.

As it happens, Australian economic data has deteriorated relative to baseline forecasts since mid-September, the very same period that a late-year swell in risk appetite washed over the financial markets. The priced in RBA outlook swung away from dovish extremes however as broader sentiment firmed.

This might help explain why the ASX rose just 2 percent in the fourth quarter while the pace-setting S&P 500 added 11.4 percent and MSCI World rose 10.1 percent. Put plainly, the rosy global backdrop just managed to keep the bears contained but struggled to lift Aussie investors’ mood in earnest.

On balance, all this might mean that traders have sniffed out underlying weakness in Australian fundamentals as a homegrown market-moving narrative, away from macro crosswinds. If so, this may set the tone for how AUD/USD and the ASX 200 trade for months to come.

AUD/USD, ASX 200 TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter