NZD/USD, AUD/USD, IG Client Sentiment Outlook - Talking Points:

- US Dollar awaiting Fed, the UK General Election, US-China tariff deadline

- Market positioning hints NZD/USD may rise as AUD/USD extends its decline

- Technical analysis warns that perhaps bulls may opt to stand aside in NZD

FX Positioning Ahead of the Fed, UK General Election and US-China Tariff Deadline

In this week’s session, I discussed what trader positioning had to say about the AUD/USD, NZD/USD and US Dollar outlook ahead of key fundamental event risk. The latter include the Fed policy announcement due later today, the UK General Election on Thursday and the December 15 US-China tariff deadline. How are investors placing their bets in the liquid sentiment-linked currencies and what does that have to say about where they may go next?

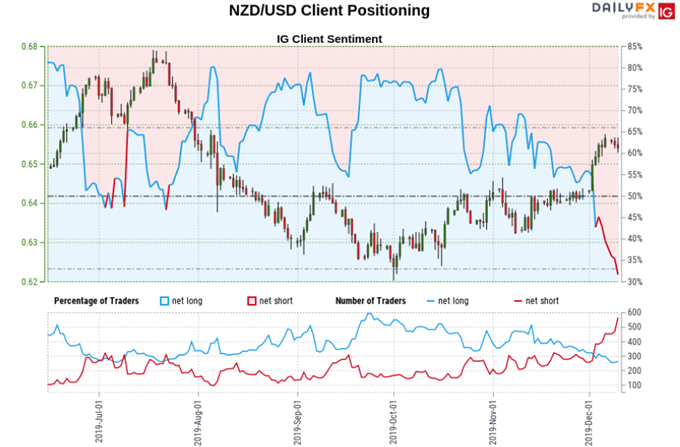

NZD/USD Sentiment Outlook

About 30 percent of NZD/USD traders – as reported via IG Client Sentiment (IGCS) – are net long as of December 10. This is as those biased to the downside are up 12.34% and 56.92% from the prior day and week respectively. The combination of current sentiment and recent changes offers a stronger NZD/USD-bullish contrarian trading bias. An uptick in net-short bets would reflect increasingly stronger belief of a turnaround.

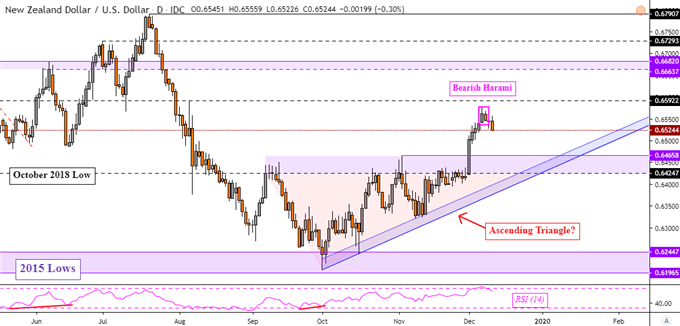

Technical analysis seems to hint otherwise. The New Zealand Dollar left behind a Bearish Harami candlestick pattern. Downside confirmation could pave the way for a reversal of the near-term uptrend from October. Yet, prices may also adhere to bullish signals after NZD broke above a Ascending Triangle, which is a bullish chart formation. As such, investors may proceed with caution until the risk of volatility dissipates.

NZD/USD Daily Chart

NZD/USD Chart Created in Trading View

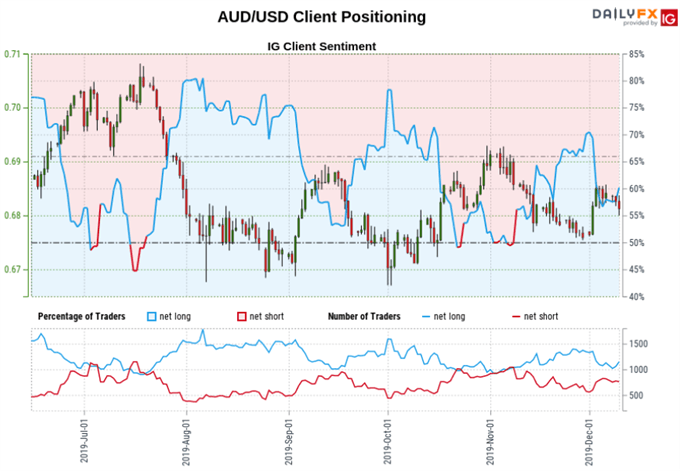

AUD/USD Sentiment Outlook

Meanwhile, about 62.70 percent of AUD/USD traders are net long. This is as net-short positioning declined 7.61% and 11.85% from the last day and week respectively. With that in mind, the combination of current sentiment and recent changes produces a stronger AUD/USD-bearish contrarian trading bias. That could speak to what may be an influx of investors attempting to pick the top in the currency pair.

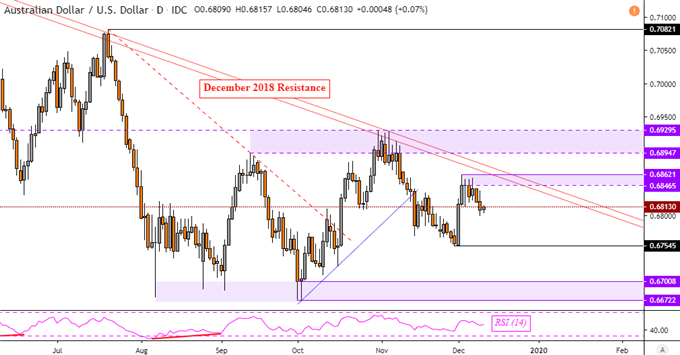

From a technical standpoint, the Australian Dollar recently stalled against the Greenback after prices left behind a range of resistance between 0.6862 to 0.6846. Since then, there has been cautious downside progress towards support at 0.6754. Clearing this point prolongs the dominant downtrend which is being upheld by descending resistance from December 2018 on the chart below.

AUD/USD Daily Chart

AUD/USD Chart Created in Trading View

*IG Client Sentiment Charts and Positioning Data Used from December 10 Report

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter