British Pound, UK Election Campaign Talking Points:

- The first debate between UK Prime Minister Boris Johnson and opposition leader Jeremy Corbyn was close

- Polls show the ruling Conservatives retain their lead, however

- The next scheduled debate is on December 6, markets will be watching

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

The British Pound’s international investors may not be as pinioned as the UK electorate by the twists and turns on the way to December 12’s general election with their overriding concern merely which of the two vastly different main candidates is going to win.

With that in mind this week’s first televised debate didn’t change matters much. The result was surely closer than the ruling Conservative Party under Prime Minister Boris Johnson would have liked. He had Labour leader Jeremy Corbyn largely beaten on the main issue of Brexit. Mr. Corbyn’s staggering refusal to state a personal view on whether the UK should indeed leave the European Union is costing him. But audiences were much less hostile to Labour on other hot-button issues like health and education.

Still, Labour remains well behind in the polls, with Corbyn’s performance doing nothing to close the gap. Debates can be high-risk for incumbent leaders, but Boris Johnson’s poll lead survived the first.

Sterling tends to gain when the Conservatives are ahead, and in some ways, it is easy to see why. Mr. Johnson has managed to get an EU withdrawal deal through parliament. It’s a compromise entirely satisfying to no one, of course. But it can be acted on quickly with negotiations then moving on to the all-important trade relationship in short order.

Markets think a Conservative Win Would at Least Break Deadlock

After more than three-years of Brexit-related turmoil and Parliamentary deadlock the Conservatives do at least offer the prospect of some early progress. Labour’s plan to renegotiate a deal and then offer the public a vote on it, or remaining in the EU, seems at face value simply a recipe for more deadlock and division, a mere electoral tactic allowing the opposition party which contains vast numbers of Leave and Remain voters to remain on the fence.

Moreover Mr. Corbyn and his front bench are arguably the most left-wing political party to come close to power in a major economy for many years. The electoral math suggests that it is very unlikely to attain anything like an overall majority, but if the Conservatives underperform, the prospect of a Labour-led coalition is very real. Sterling markets would probably weaken sharply and very considerably were that to occur.

Whether it will of course won’t be known until the votes come in, but there are some likely days of concern for sterling investors between then and now. Another debate between the two leaders is coming up on December 6. Both will be hoping they can move the dial a little more than they did in their first clash, but both are known quantities and a mass changing of minds seems unlikely.

Broadcaster Sky has mooted the idea of a triple-header next week with third-place party leader Jo Swinson of the Liberal Democrats included too, but the willingness of the other two to permit this is not yet known.

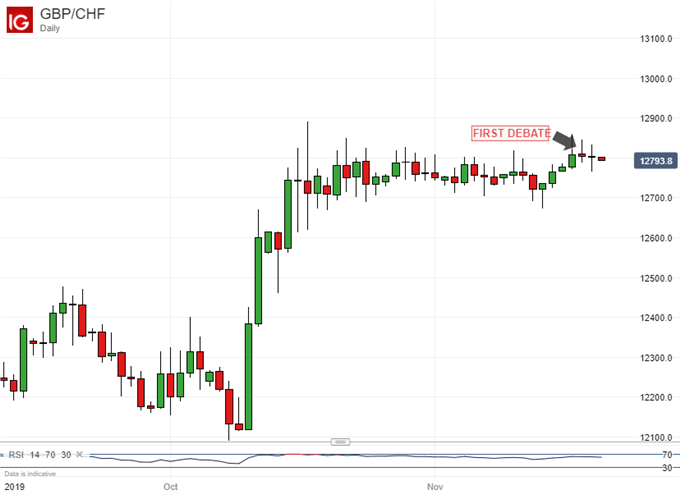

The Pound has made gains since Johnson took office. These accelerated when hopes that a Brexit deal could at last pass Parliament were fulfilled in October.

The currency has been quite steady against the haven Swiss Franc through November as campaigning got under way.

This is probably due to the Conservative Party’s consistent poll outperformance. If it endures, the underlying bid for Sterling may be safe enough. But polls have been hugely wrong before in the recent past. They suggested that Johnson’s predecessor Theresa May was assured of an increased majority when she went to the country in 2017. In the event she lost her majority entirely, and fired the starting gun on years more Brexit-related turmoil.

With that in mind there’s still huge downside risk in the most crucial OK election for years draws near and the Pound is likely to remain vulnerable at least until we see the result.

British Pound Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!

https://www.dailyfx.com/webinars?re-author=Cottle