ASEAN Fundamental Outlook

- US Dollar weakness failed to translate into uniform ASEAN FX appreciation

- Obstacles in US-China trade talks are a downside risk for emerging markets

- Singapore Dollar and Malaysian Ringgit eye CPI data, Rupiah to a rate cut

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

US Dollar and ASEAN FX Weekly Recap

It was another disappointing week for the highly-liquid US Dollar as the DXY closed at its lowest since August. The Greenback succumbed to selling pressure amid disappointing local economic data as an improvement in sentiment sapped the appeal of haven assets. Dismal US retail sales fueled Fed rate cut expectations as Brexit deal hopes boosted the British Pound. Mixed China GDP and industrial production passed without fireworks.

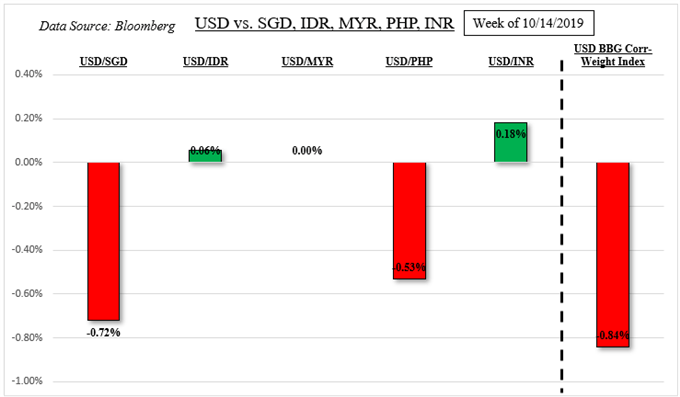

The Dollar’s performance against its ASEAN peers was not uniform. It experienced the most selling pressure against the Singapore Dollar (despite easing from the MAS) and the Philippine Peso – see table below. The Malaysian Ringgit, Indonesian Rupiah and Indian Rupee struggled to capitalize on declines in the US Dollar even though earlier this month, the US and China agreed to a “phase one” trade deal in ongoing talks.

For timely updates on ASEAN and Southeast Asia currencies, make sure to follow me on Twitter here @ddubrovskyFX

US-China Trade Talks – Ongoing Issues

Perhaps the hesitation in some of these currencies reflect ongoing uncertainties in US-China trade talk progress. The latter made it clear this past week that it wants the former to further reduce tariffs against it before committing to purchasing as much as $50b in US agricultural products. China also threatened to retaliate should the US pass a controversial bill that would support protestors in Hong Kong.

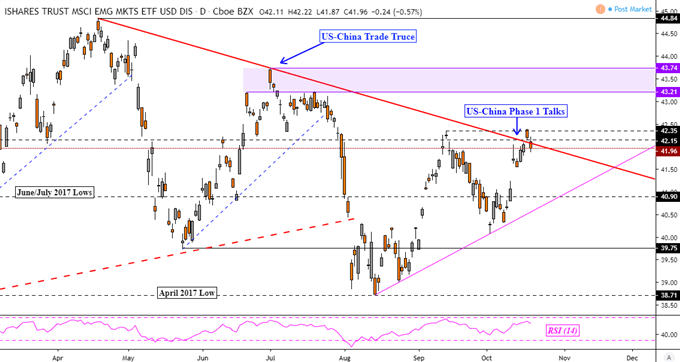

These are just some of the obstacles the two nations face ahead of the APEC meeting in November where a trade deal signing could occur. Taking a look at the MSCI Emerging Markets Index, it continues to struggle pushing above key descending resistance from April. Its performance reflects similar price action back in June following the US-China “trade truce” at the G20 Summit in Japan.

MSCI Emerging Markets Index

Chart Created Using TradingView

Singapore CPI, Malaysia CPI, Bank of Indonesia

Focusing on the ASEAN regional docket, the week ahead contains the next round of inflation data (September) from Malaysia and Singapore on Wednesday. Malaysian CPI is expected to clock in at 1.3 percent y/y, down from 1.5% in August. Headline Singapore CPI is anticipated to show an unchanged 0.5% y/y outcome. Both rather low reading continue to underpin efforts from their central banks to ease policy.

Check out my Singapore Dollar currency profile to learn about how the MAS conducts monetary policy!

Then on Thursday, Bank of Indonesia is expected to reduce its benchmark lending rate to 5.25 percent, following the trend of central bank easing seen around the world. This is to support economic conditions amid a slowdown in global growth. Yet, weakness in the Rupiah could be limited. The Bank of Indonesia took measures in the recent past to guard the IDR and may continue doing so.

US Economic Data

Focusing on the US Dollar and domestic issues, local economic news flow continues to disappoint relative to economists’ expectations. More of the same this week in durable goods orders, existing housing sales and Markit manufacturing PMI may underpin the case for Fed rate cut bets. That may further pressure the Greenback in the near-term. Don’t be surprised though to see a comeback in USD if risk aversion kicks in.

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter