Brexit, GBP Outlook, Swedish Krona, Norwegian Krone – TALKING POINTS

- GBP braces for EU summit as the October 31 deadline approaches

- Swedish Krona, Norwegian Krone may oscillate with British Pound

- IMF, World Bank reports, Q3 corporate earnings may spook markets

Learn how to use political-risk analysis in your trading strategy!

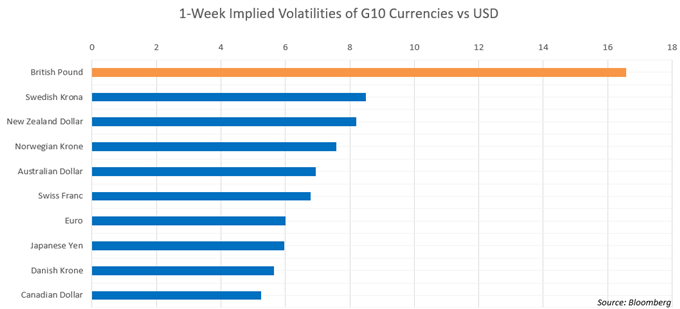

The Swedish Krona and Norwegian Krone along with the British Pound will be in for a volatile week ahead of major geopolitical uncertainty in the United Kingdom. Volatile Brexit drama continues to be reflected in Sterling, as seen in last week’s price move where EUR/GBP erased an over 20-day ascension in just 24 hours. This week, the cycle-sensitive NOK and SEK may also convulse alongside the Pound amid the pandemonium.

Brexit: British Pound Traders Coil up For Political Volatility

On Monday, Queen Elizabeth II will open a new session of parliament where she will also outline Prime Minister Boris Johnson’s new legislative agenda. Lawmakers in Parliament will scrutinize and debate the PM’s plans, with speculation that it could lead to a vote of no confidence and even a possible snap election. But the real event risk to watch for the week in the context of Brexit will be the EU summit.

Between October 17-18, EU and UK officials will be entering an intense phase of negotiations as the October 31 deadline approaches. Last week, Mr. Johnson and his Irish counterpart Leo Varadkar spoke and gave Sterling a boost after the latter said he sees a path forward with Brexit. The issue over the Irish backstop has been the biggest tie-up in Brexit negotiations, so progress on that key front left traders rejoicing.

However, diplomats from both sides have expressed doubt that a meaningful deal can be made by the end of the week. EU Council President Donald Tusk has said that the UK has “still not come forward with a workable, realistic proposal” despite time running out. Throughout the week, investors and the Pound will both be coiling up, ready to pounce in either direction should a pathway forward to a deal be obstructed or opened up further.

US-China Trade War: What’s Happening?

Over the weekend, US President Donald Trump announced over Twitter that China will immediately start purchasing agricultural products from the US. He also said Washington will delay imposing tariffs set for October 15, citing that “Phase One” of the trade agreement is nearly complete and they will start “Phase Two” shortly after.

Markets appeared little-moved by the news, which suggests they may be waiting for something more substantial from both sides. Given the erratic diplomatic exchanges between the US and China, this does not come as a surprise that investors are perhaps waiting for something to be put in writing before they put their money on the line.

Equities, Commodities Brace for Global Growth Updates, Corporate Earnings

Market volatility may also be exacerbated this week by a cascade of third quarter corporate earnings reports along with a series of meetings and conferences with the IMF and World Bank. Last week, the newly-appointed IMF Director Kristalina Georgieva warned that the world is experiencing a “synchronized slowdown” amid strained international trade tensions.

This week, she is expected to carry the same gloomy undertones at an annual meeting in Washington DC. World Bank President David Malpass will also preside over the event with other key figures such as Ray Dalio of Bridgewater Associates and David Solomon of Goldman Sachs. The Institute of International Finance will also be holding its annual membership meeting on with key officials whose comments may spark volatility.

Sweden Unemployment Data

While data out of Norway is sparse for the week, Sweden will be publishing its unemployment rate for September with an estimate of 6.7 percent, slightly lower than the previous 7.1 percent figure. Riksbank policymakers are growing increasingly anxious that they may not be able to squeeze in their planned rate hike for this year against the backdrop of Brexit, international trade tensions and lackluster Eurozone growth.

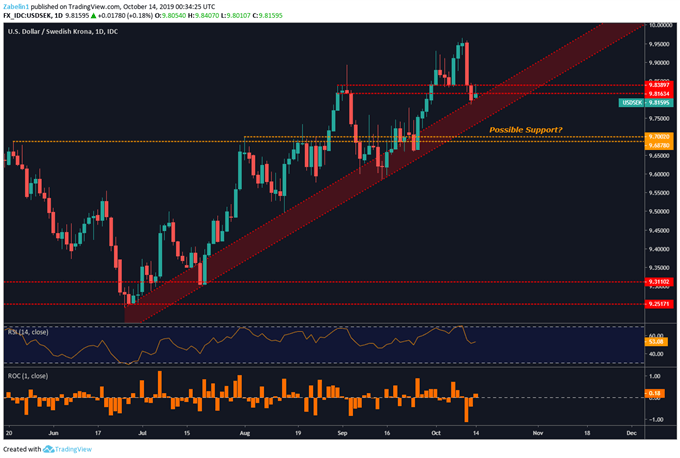

USD/SEK Technical Analysis

USD/SEK is struggling to break above the 9.8163-9.8389 resistance range while flirting with the upper lip of the rising support zone (red parallel channel). A break below it with follow-through could lead to an aggressive selloff and expose the pair to a floor between 9.6878-9.7000 (yellow dotted lines).

USD/SEK – Daily Chart

USD/SEK chart created using TradingView

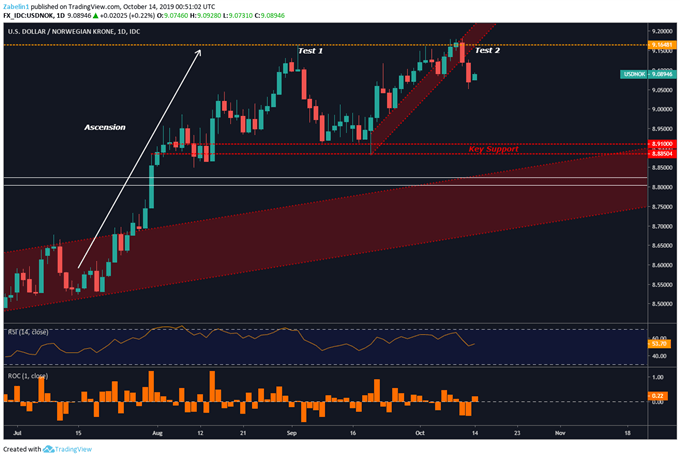

USD/NOK Technical Analysis

USD/NOK appears to be coming closer to completing a bearish Double Top reversal pattern after it failed to meaningfully break past resistance at 9.1648. This also comes as a short-term rising support channel was broken amid the formation of the second attempt to breach resistance. Looking ahead, USD/NOK may accelerate downward until its hits a key support zone between 8.8850-8.9100.

USD/NOK – Daily Chart

NOK, SEK TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter