CRUDE OIL PRICE FORECAST: NEUTRAL

- Crude oil prices remain anchored to broad-based market mood swings

- OPEC+ output scheme and geopolitical jitters unable to sustain gains

- Incoming economic data, central bank commentary to apply pressure

Get our free guide to help build confidence in your crude oil trading strategy !

Crude oil prices remain anchored to broad-based sentiment prevailing on global financial markets. This bodes decidedly ill for the cycle-sensitive commodity as US-China trade war escalation disrupts supply chains vital to worldwide economic activity and an inverted yield curve raises the specter of recession.

Tellingly, prolonging an OPEC-led coordinated output cut scheme has failed to break the medium-term downtrend. Worries about supply disruption in the critical Strait of Hormuz amid sporadic sparring between the US and Iran have likewise failed to generate lasting gains.

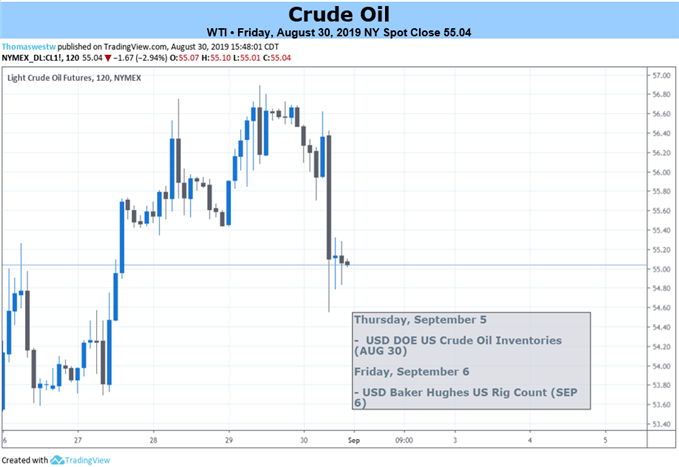

CRUDE OIL PRICES BIASED LOWER AMID TRADE WAR, RECESSION FEARS

The week ahead is replete with opportunities to remind investors of the gathering headwinds. Policy announcements from the RBA and the Bank of Canada will almost certainly bemoan slowing growth, singling out trade tensions as a particularly insidious catalyst.

On the data front, PMI and ISM surveys will probably make for grim reading. They will offer between them a timely view of economic activity trends in China, the Eurozone, the UK and the US. Australian GDP data is also due, with baseline forecasts envisioning a slowdown.

Finally, the closely-watched US jobs report is expected to show hiring picked up while the unemployment rate held steady near 50-year lows in August. Somewhat counterintuitively, such news is likely to hurt sentiment against the current backdrop in that it might discourage aggressive Fed stimulus expansion.

In all, this seems to mean that crude oil’s grinding four-month downtrend is likely to continue. Bursts of upward momentum may emerge as markets react to any Tweetstorms from Washington and the inevitable retorts to them from Beijing or Tehran, but such spikes have yet to find follow-through.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

CRUDE OIL TRADING RESOURCES

- Just getting started? See our beginners’ guide for traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a live webinar and have your trading questions answered

OTHER FUNDAMENTAL FORECASTS:

Australian Dollar Battered Amid Market Turmoil Faces RBA and GDP