NORDIC FX, NOK, SEK WEEKLY OUTLOOK

- US Dollar may rise vs Nordic FX amid trade wars, FOMC minutes, Italian politics

- Critical data out of the Eurozone and US may exacerbate growing recession fears

- Commentary from officials at Jackson Hole symposium could induce risk aversion

See our free guide to learn how to use economic news in your trading strategy !

The US Dollar may extend gains vs Nordic FX if growth concerns continue to pressure cycle-sensitive currencies and redirect capital to anti-risk assets. US-China trade tensions appear to be escalating against the backdrop of growing political uncertainty in Italy. Recessionary fears may be exacerbated this week from the release of the FOMC meeting minutes and commentary from officials at the Jackson Hole symposium.

Financial Markets Brace for Deteriorating US-China Trade Relations

Early into Monday’s Asia-Pacific trading hours, US President Donald Trump held a press conference and said he was not ready to make a trade deal with China and that Huawei posed a threat to national security. Furthermore, he also said reaching a trade agreement with Beijing may be more difficult if the violence amid the protests in Hong Kong continues. Greater friction will likely continue to erode market sentiment.

FOMC Meeting Minutes: Will the Transcript Simply Re-Emphasize the Market’s Worse Fear?

As outlined in my weekly US Dollar forecast, the Greenback may rise at the expense of equity markets when the FOMC meeting minutes are released. The prospect of cheaper credit has remained a key factor buoying investor sentiment as the fundamental outlook continues to dim. What the minutes will likely show is just a more detailed message from the last meeting by Fed Chairman Powell: The Fed is not as dovish as you think.

Jackson Hole Symposium May Pressure Nordic FX if it Exacerbates Global Growth Fears

Fears about the prospect of a recession gained momentum last week after a number of recessionary signals began to sound the alarm. Commentary from officials at the symposium may exacerbate global growth fears and could pressure export-oriented currencies like the Swedish Krona and Norwegian Krone. However, amid the uncertainty and search for liquidity, the US Dollar may catch a haven bid.

G7 Summit Will be Closely Eyed by Investors Amid Rising Geopolitical Tensions

Traders will be closely monitoring the G7 Summit this week in Biarritz, France from August 22-24. Given the current state of rising geopolitical tensions around the world, looking for key developments at this conference will be crucial. Some key topics will include Facebook's Libra cryptocurrency, US-China/EU trade and discussing the replacement of IMF chief after Christine Lagarde transitions to her post as ECB president.

ECB Minutes May Spook European Markets Despite Prospect of Stimulus

The publication of the European Central Bank’s meeting minutes is expected to carry dovish undertones after central bank president Mario Draghi said monetary authorities are entertaining QE and rate cuts. However, optimism about the prospect of cheap credit may be overwhelmed by gloomy undertones if the overall message of the transcript is prevailing conditions are so severe that they require stimulative policy measures.

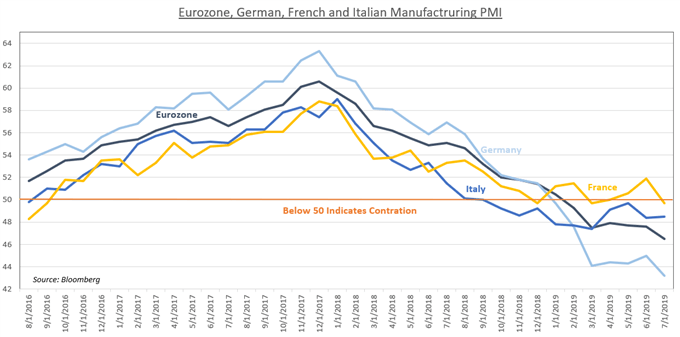

A Chilling Outlook for European Growth

Italian Political Uncertainty May Sap Confidence, Weigh on Nordic FX

Political volatility out of Italy will likely sap confidence in European markets and pressure the sentiment-linked Krone and Krona. The Riksbank has repeatedly cited political risk out of the EU as a key source of uncertainty. Deputy Prime Minister Matteo Salvini will attempt to consolidate power and break away from his coalition in order to end cabinet infighting and push forward his market-disrupting fiscal agenda.

Critical Data out of EU, US May Induce Risk Aversion

Traders will also be watching the release of key US and EU economic data. The more notable ones include Eurozone inflation, flash PMIs and consumer confidence, US manufacturing PMIs and new home sales reports. A poor reading from these indicators will likely only strengthen the case for central banks to adopt accommodative monetary policy measures and will likely send a chilling message to Nordic FX markets.

SWEDISH KRONA, NORWEGIAN KRONE TRADING RESOURCES

- Join a freewebinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter