S&P 500 INDEX, FED RATE CUTS, US CHINA TRADE WAR – SUMMARY POINTS

- The Federal Reserve cut its policy interest rate last month for the first time in a decade which helped push the S&P 500 Index to fresh all-time highs

- Stock market returns are mixed following the start of a Fed rate cut cycle, but recent history and US China trade war risk paints a bleak picture for S&P 500 Index outlook

- Download the free Q3 Equity Forecast for comprehensive fundamental and technical analysis on the major global stock market indices

Over the last few months, financial markets have observed a sharp shift in monetary policy outlook from the Federal Reserve (Fed). The US central bank has quickly pivoted away from a hawkish stance with 3 rate hikes expected for 2019 this past December to its current dovish position. The new accommodative posturing was confirmed following the July Fed meeting which revealed a “mid-cycle adjustment” to monetary policy with a 25-basis point cut to its benchmark interest rate.

Stock market investors were widely expecting the Fed to cut rates last month and drove the S&P 500 Index to notch a string of record-high closes in the runup to the FOMC’s decision to ease policy. While Federal Reserve Chair Jerome Powell highlighted weak business investment and tepid inflation as the primary factors contributing to the latest rate cut, mounting downside risks to the economy and investor sentiment – predominantly surrounding the US China trade war – have largely driven the market’s expectations for future monetary policy decisions.

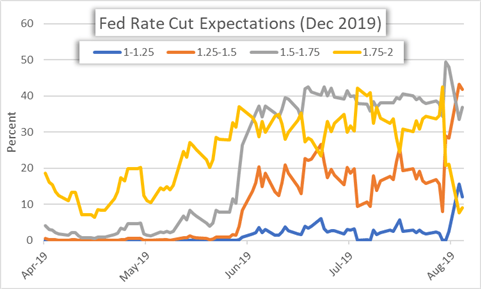

FED RATE CUT EXPECTATIONS & US CHINA TRADE WAR DEVELOPMENTS

According to overnight swaps, rate traders are now pricing in another 75-basis points of cuts to the Fed’s policy interest rate, which currently stands at 2.00-2.25 percent, by the end of the year. Considering that elevated market risks revolving tariffs and the latest US-China trade warescalation have contributed to the market anticipating lofty monetary policy easing by the Federal Reserve, it is likely that the Fed will continue to embark down the road of lower interest rates. But will Fed rate cuts be enough to fend off a widespread market downturn from the impact of an ongoing trade spat between the world’s largest two economies?

STOCK MARKET PERFORMANCE WHEN THE FED CUTS RATES

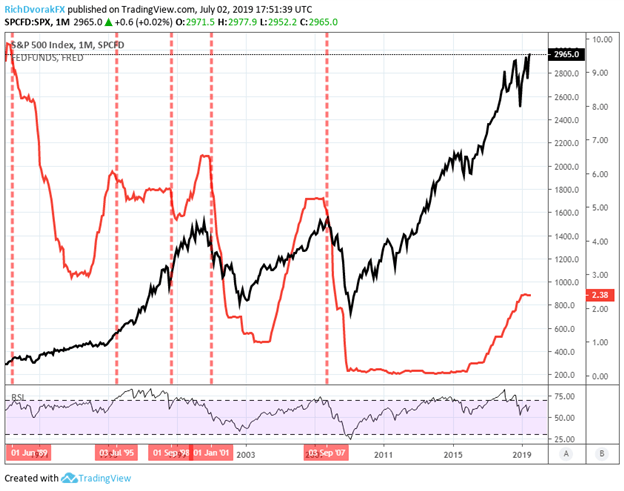

Historically speaking, stocks tend to benefit from the onset of lower interest rates from the Federal Reserve. This relationship can be observed in chart 1 below which depicts the monthly change in the S&P 500 Index and the effective federal funds rate (FFR).

S&P 500 INDEX PRICE AND EFFECTIVE FEDERAL FUNDS RATE OVERLAY – CHART 1

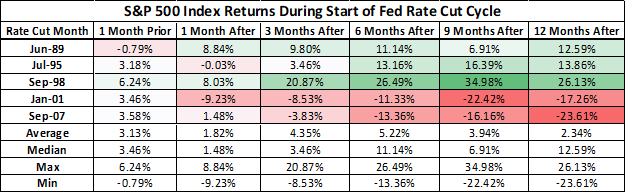

For the Fed rate cut cycles beginning July 1995, September 1998, January 2001 and September 2007, the S&P 500 Index posted positive returns of 3.18 percent, 6.24 percent, 3.46 percent and 3.58 percent respectively and is detailed below in chart 2. Although, the S&P 500 Index slid a mere -0.79 percent during the month prior to the start of the Fed rate cut cycle beginning June 1989.

S&P 500 INDEX RETURNS DURING START OF FED RATE CUT CYCLES – CHART 2

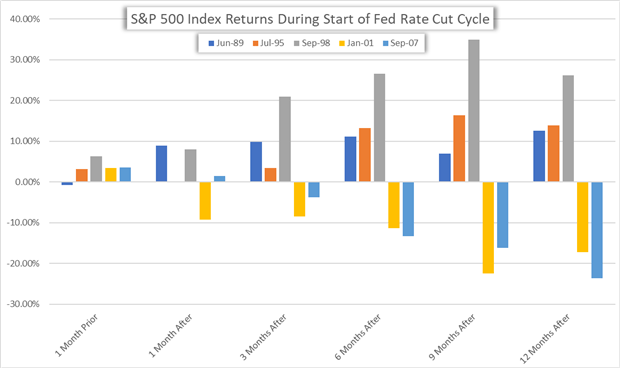

While the small sample set limits the ability to make statistical inferences, the variance of S&P 500 Index returns rises dramatically in the 3-months, 6-months, 9-months and 12-months following the start of a Fed rate cut cycle. Looking out a year after the FOMC begins to ease monetary policy, the S&P 500 Index was higher by 12.59 percent, 13.86 percent and 26.13 percent from June 1989, July 1995 and September 1998 whereas the stock market dropped -17.26 percent and -23.61 percent from January 2001 and September 2007.

STOCK MARKET PERFORMANCE WHEN THE FED BEGINS TO EASE MONETARY POLICY – CHART 3

Aside from the Sino-American trade conflict, several business cycle indicators – like the yield curve inversion – amid decelerating GDP growth suggests that the global economy is losing momentum quickly and suggest that the latest expansion may be on its last leg.Additionally, economic weakness is being hinted at by muted inflation and fading strength in the US labor market. As such, the drastic deterioration in economic data and ballooning market uncertainty has backed the Fed into a corner with little choice but to juice the slowing economy with monetary stimulus.

S&P 500 INDEX PRICE OUTLOOK WHEN THE FEDERAL RESERVE CUTS INTEREST RATES

Generally-strong equity returns in the month leading up to a Fed rate cut could be explained by the market’s hope that the Fed can step in to bolster investor confidence by saving declining asset prices and a slowing economy with looser financial conditions. Also, a reduction in the Fed rate increases the equity term premium and thereby boosts the relative attractiveness of stocks to bonds and other asset classes.

Yet, the S&P 500 Index still managed to sink 6 percent from its all-time high recorded a week ago as the latest flareup in the US China trade war bludgeoned risk assets. This occurred in spite of the Fed rate cut last month and the central bank’s conveyed willingness to further ease monetary policy. As such, the overwhelming impact of trade tension between the US and China will likely continue to overshadow Fed rate cuts and bullish prospects for the stock market.

Correspondingly, it is difficult to imagine that the already-diminishing impact of loosening monetary policy can overcome the daunting headwind posed by global trade friction, decelerating GDP and deteriorating equity earnings. With the Fed controversially cutting rates once already this year, there is arguably less “monetary policy ammunition” to counter the next downturn. Furthermore, if the macro-economy truly needs as much monetary stimulus as markets are currently pricing, investors could be in for a rude awakening when the longest business cycle in history officially comes to an end.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight