Equity Analysis and News

- DAX Posts Best Month Since Q1 2018

- ECB Preparing to Deliver Fresh Stimulus

- Beware of Low Equity Market Volatility

DAX Posts Best Month Since Q1 2018

Expectations for looser monetary policy from the likes of the Fed and ECB, alongside a ceasefire in the US-China trade war has seen the DAX recoup its losses from May, posting its best monthly performance since the beginning of 2018. On a stock specific basis, the best individual performers within the DAX had been Bayer, which saw activist investors Elliot Advisors disclose a EUR 1.1bln stake, while the company had also benefitted from reports that the company may be open to a quicker than expected settlement over glyphosate cases.

ECB Preparing to Deliver Fresh Stimulus

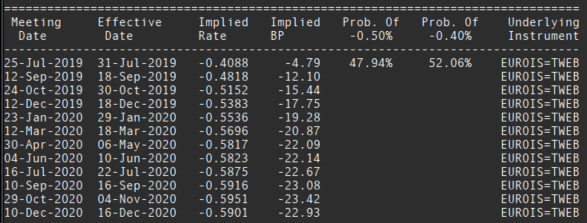

In response to the plummet in market-based inflation expectations, ECB President Draghi stated at the Sintra Forum that unless economic conditions in the Euro-Area had improved, the central bank would be open to fresh policy stimulus via rate cuts and a restarting of QE. Consequently, Draghi had seemingly placed a low bar in which the ECB will ease monetary policy further, thus the DAX is back in a bull market (rising over 20% since December 2018 lows). Alongside this, eyes will be on the July meeting in which the ECB could lay the foundations for a round of fresh easing at the September meeting. Of note, money markets are fully pricing at least a 10bps rate cut in the depo rate at the September meeting.

Source: Thomson Reuters. ECB rate expectations

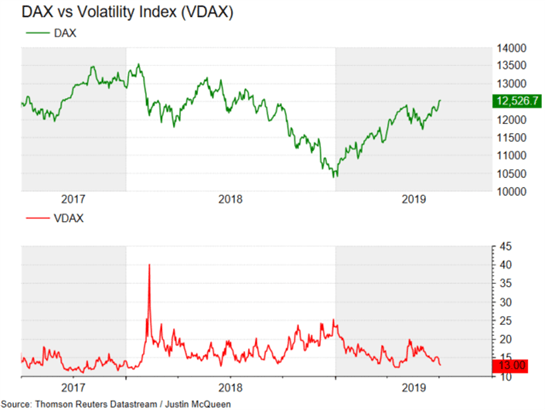

Beware of Low Equity Market Volatility

As the DAX has continued to grind higher, the DAX implied volatility index (VDAX) has edged lower, hovering around very subdued levels once again. While seasonal factors, such as moving into the summer lull can be partly to blame here, there is a risk of potential complacency, which sees traders underpricing risks in the form of slowing global growth. As such, eyes will be on the lookout for a spike in the volatility index, which could spark a pullback in the index.

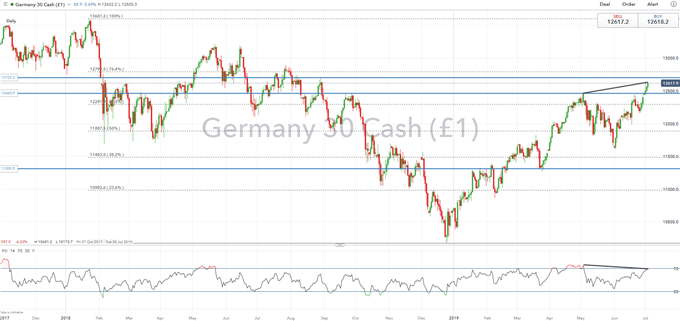

DAX Price Chart: Daily Time Frame (Oct 2017 – Jul 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX