WILL SLOWER ECONOMIC GROWTH & TRADE WARS DRAG CRUDE OIL PRICES?

Since Q2, oil prices have fallen a little over seven percent, considerably less than the 30-plus percent climb they experienced at the beginning of the year. Rising concerns about the pace of global economic growth is pressuring WTI as inventories bulge while many central banks are halting – and in some cases entirely reversing – monetary policy normalization and their rate hike cycles hoping to shore up weakening fundamentals.

Decelerating GDP growth out of powerhouse economies like China, the EU and US may continue to weigh on oil demand and prices. In Europe, ECB policymakers have recently concluded a symposium in Sintra, Portugal where central bank President Mario Draghi alluded to possible future rates cuts and the re-introduction of QE. Slowing economic growth and inflationary pressures in Europe have been lagging while expectations for price growth remain unfavorable.

Demand for oil which mirrors slowing GDP growth out of these economies has created a supply imbalance and looks to keep crude oil prices under pressure. Oil price weakness threatens to be exacerbated by US Department of Energy (DOE) reports detailing that total crude production is increasing along with inventories. Additionally, the number of oil rigs in use has fallen and demonstrates that production efficiency is increasing. If US crude oil producers decide to open up the spigot and increase operational capacity, crude oil prices may plummet further.

OIL PRICE CHART VOLATILITY THREATENS TO DRAG CRUDE LOWER

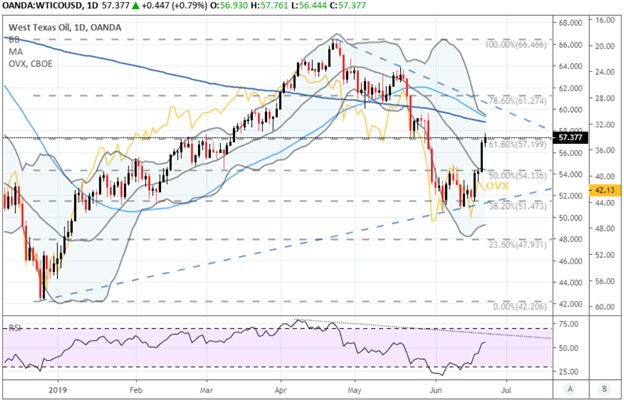

With crude being strong-armed by both bullish and bearish headwinds, oil price volatility (measured by Cboe’s OVX Crude Oil Volatility Index, shown inverted) risks rising which possibly suggest weakness in WTI ahead due to the generally strong negative relationship between the two assets. The daily chart also reveals that an impending death cross of the 50-day and 200-day SMAs threatens to keep crude oil prices subdued.

If market sentiment sours at technical resistance near the 61.8 percent Fibonacci level, confluence around $54.00 per barrel and the 50.0 percent retracement of crude’s year-to-date trading range has potential to keep oil prices bid. Moreover, forthcoming weakness in crude is perhaps hinted at by fading momentum shown by the downtrend in oil’s 14-day relative strength index (RSI). Crude oil might sink toward support at the $52.00 level if the longer-term bullish uptrend from the December 2018 low fails to bolster prices. Conversely, upside could target $62.00 and the 78.6 percent Fib before eyeing the $66.00 per barrel price level again.

OIL TRADING RESOURCES

- Find out how to trade crude oil

- Read up on these crude oil facts every trader should know

- Sharpen your trading strategy by avoiding the #1 mistake made by traders

- Join DailyFX analysts by registering for regularly-held webinars to have your trading questions answered

--- Written by Dimitri Zabelin and Rich Dvorak, Junior Analysts for DailyFX.com

Connect with @ZabelinDimitri and @RichDvorakFX on Twitter for real-time market insight