TALKING POINTS – ECB PRESIDENT MARIO DRAGHI, ITALY BUDGET, EU COMMISSION

- ECB President Mario Draghi and officials meet in Portugal

- Policymakers will be discussing need for Eurozone stimulus

- Italy budget risks continue to escalate – the clock is ticking

See our free guide to learn how to use economic news in your trading strategy !

EURUSD will be closely watching a meeting tomorrow in Portugal where ECB President Mario Draghi and central bank policymakers will be gathering to discuss whether there is an additional need for stimulus. BoE Governor Mark Carney will also be joining the event and will be featured as a speaker on the panel ahead of the rate decision on June 20.

Despite a minor improvement, economic data in the Eurozone continues to broadly underperform relative to economists’ expectations. Weakening domestic demand against the backdrop of fading global growth is providing an inhospitable backdrop for many central banks that were intending on raising rates. In fact, overnight index swaps are pricing in a 51% percent probability of a rate cut by the ECB’s October meeting.

In Italy, political risks are continuing to mount with Rome and Brussels heading for a long-awaited showdown over the former’s budgetary ambitions. EU officials met last week to discuss how to approach Italy’s attempt at pioneering regional fiscal exceptionalism, with most lawmakers agreeing that the third largest Eurozone economy is not immune to the rule of law.

European Commissioner for Economic and Financial Affairs, Taxation and Customs Pierre Moscovici at the meeting said that the rules are to be respected and that Italy’s numbers for 2019 and 2020 have to add up. Rome has approximately a week to reply to the EU’s financial assessment. On July 9, EU Finance Ministers will be convening in Brussels where they are expected to decide on formally opening the EDP against Italy.

The next date to keep in mind will be July 29. This is the official deadline for when the European Commission would formally recommend financial sanctions against Italy – an unprecedented move. The penalty could include a non-interest-bearing deposit of up to 3.5 billion euros, with scope for more if Rome refuses to alter its budgetary trajectory.

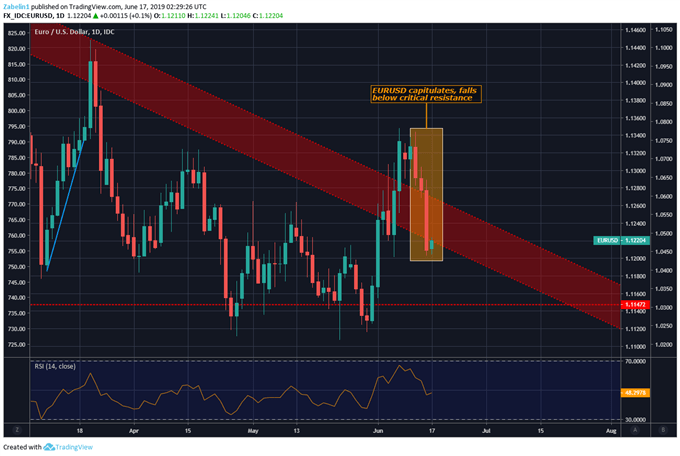

EURUSD TECHNICAL ANALYSIS

If budgetary tensions continue to escalate alongside slower economic growth and uncertainty over Brexit, EURUSD my struggle to re-enter the 18-month descending resistance. The pair recently broke above it, though ultimately the Euro lacked resolve and collapsed under the weight of a stronger Greenback. If global growth prospects continue to deteriorate, EURUSD may struggle to rise as investors flock to the highly-liquid US Dollar.

CHART OF THE DAY: EURUSD FALLS UNDER DESCENDING RESISTANCE AFTER BRIEF JUMP ABOVE

FX RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter