GLD & HYG ETF:

- The HYG ETF saw its largest ever single-day inflow on Tuesday following dovish Fed remarks

- Similarly, the gold-tracking GLD ETF saw its largest inflow for the year as inflation expectations surge

- Retail traders are overwhelmingly short the Dow Jones and S&P 500, find out how to use IG Client Sentiment Data with one of our Live Sentiment Data Walkthroughs

Gold and High Yield Debt Funds See Record Inflows on Dovish Fed

Investors hopes for a rate cut from the Federal Reserve surged on Tuesday when Fed Chairman Jerome Powell issued a series of dovish-leaning remarks. The argument for a reduction in the Fed Funds rate was only bolstered on Friday with the release of a weaker than expected Non-Farm Payroll report. Consequently, the S&P 500 and Dow Jones look to rally into Friday’s close. The higher likelihood of a cut resulted in newfound clarity for many market participants and allowed investors to move funds in earnest – resulting in the largest inflow ever for the high yield corporate debt ETF, HYG.

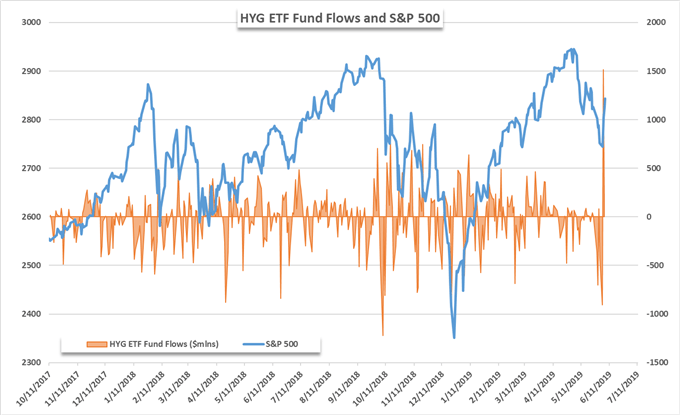

Investors Flock to HYG

Data source: Bloomberg

Tuesday’s inflow of roughly $1.5 billion was the largest on record for HYG. It follows last week’s outflows, one of which was the largest in 2019. Further, the $1.5 billion in fresh capital nearly doubled the previous record of roughly $790 million in October. The demand reflects the state of monetary policy and its relationship with risk and return.

Check out the DailyFX Trading Guides page for quarterly forecasts, educational content and more.

HYG offers exposure to debt typically viewed as risky but compensates by offering a high return. With the Fed’s dovish remarks, the benefit of holding effectively risk-less US treasuries was dented while the outlook for beleaguered companies was bolstered – as money looks to remain cheap or become even cheaper. That shift has increased the attractiveness of HYG – thus the inflow.

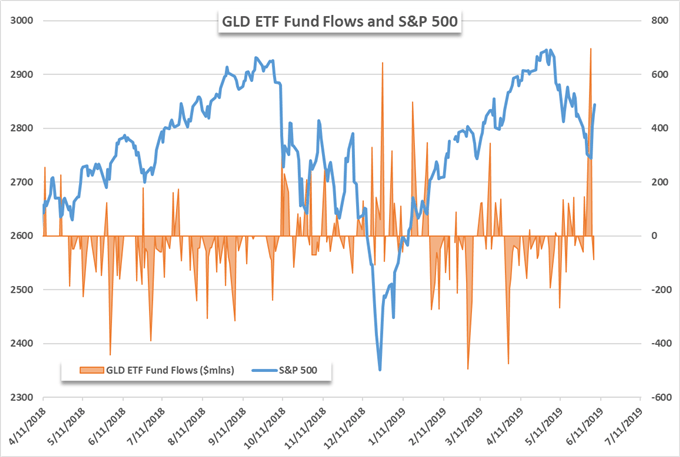

Gold Price and GLD Shine

At the same time, a dovish Fed has riled inflation expectations. While central bank officials have stated they will not hike rates to curb trade war-related inflation, the prospect of rate cuts increases future inflation expectations nonetheless. As a key hedge against inflation, gold spiked to fresh 2019 highs and the gold-tracking GLD ETF saw its largest inflow for the year.

Data source: Bloomberg

The $696 million inflow into GLD marks the largest over the last year and brings the 2019 total to a net outflow of -$1.2 billion. With gold at fresh highs and the odds of a rate cut soaring, the precious metal could look to drive higher despite the relatively risk-on mood of markets this week. For more ETF analysis and commentary, follow @PeterHanksFX on Twitter.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Stock Market Volatility and its Relationship with S&P 500 Returns

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.