S&P 500 Earnings Season Talking Points:

- Among the most noteworthy corporations to report earnings before Tuesday’s open, Twitter may be one stock to experience considerable volatility

- Earnings season will continue to influence price action ahead of Friday’s US GDP release

- Interested in stock market sentiment? See how IG Clients are positioned on the S&P 500 with Retail Sentiment Data and sign up for one of our Sentiment Walkthrough Webinars to learn more about the tool

S&P 500 Earnings Season: Implied Volatility for Tomorrow's Top Stocks

The week ahead will see more than 150 companies listed on the S&P 500 report their performance from the first quarter. While Friday’s release of US 1Q GDP may carry more weight for global macro concerns, earnings will offer single-stock volatility. Should a discernible trend arise across the reports, earnings taken in aggregate may influence macroeconomic outlooks. While the market awaits those grandiose takeaways, implied volatility for corporations that report tomorrow is heightened.

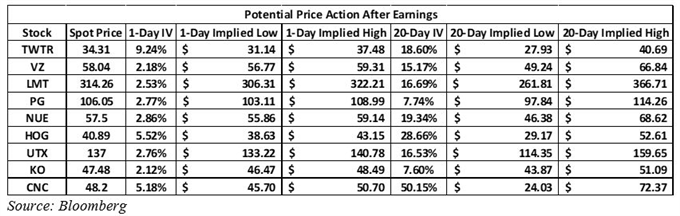

S&P 500 Earnings Before Market Open: Tuesday, April 23

First and foremost, option traders are expecting a sizable price reaction from Twitter following the release of earnings on Tuesday morning. With a 1-day implied volatility of 9.24%, option pricing suggests the social media stock may slump as low as $34.31 or ascend as high as $37.48. Apart from Twitter, implied volatility is less pronounced – likely due to a combination of factors such as relative market capitalization and industry.

That said, Harley Davidson (HOG) and Centene Corporation (CNC) are also expected to see higher than average volatility. Harley has had to grapple with the ire of President Trump in the past, and new trade war fronts threaten to punish the stock further. On the other hand, Centene faces the industry-wide headwind that healthcare has had to weather over the last two weeks.

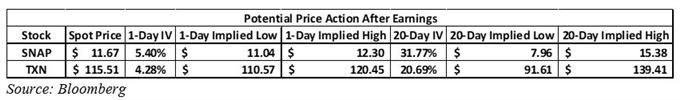

S&P 500 Earnings After Market Close: Tuesday, April 23

By comparison, option pricing suggests companies reporting after the closing bell will experience greater volatility. Two household names - Snapchat (SNAP) and Texas Instruments (TXN) – may see larger price swings in after-hours trading which will likely spill into Wednesday. Further, due to industry classification and therefore beta, volatility will remain heightened in the following 20 days. Follow @PeterHanksFX on Twitter for earnings season coverage. In the interim, check out the weekly fundamental forecast for the S&P 500, Dow Jones, DAX 30 and Nikkei 225.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: History Suggests the Stock Market Will Climb in the Weeks After Easter

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.