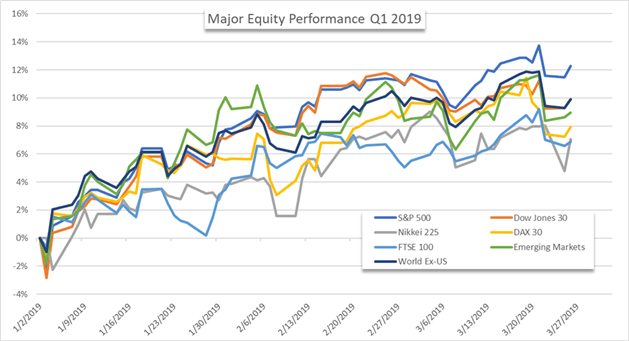

Global shares rebounded in the first quarter as dovish monetary policy was able to overcome global growth concerns and US-China trade war fears were reduced by the prospects of a deal. A decidedly accommodative Federal Reserve and another round of targeted long-term refinancing operations (TLTRO) from the European Central Bank were able to help buoy equities in two of the world’s largest financial markets. An admirable performance from the United States and European equity markets was met with a resurgent desire for risk exposure as emerging markets rallied alongside the developed world.

The respective policy announcements offered meaningful contributions to the first quarter rebound, as quantitative easing won out over further tightening – a key concern for equity markets in the latter half of 2018.Meanwhile, the US-China trade war remains unresolved – though confidence of a slowly approaching deal has waxed and waned through the past year. A mood of optimism swept over market participants in the first quarter as officials from both countries touted progress and the potential for a resolution.

---Written by Paul Robinson, Market Analyst and Peter Hanks, Junior Analyst for DailyFX.com