Stock Market Talking Points:

- The short trading week offered muted fund flows as the Dow Jones crossed 26,000

- Next week’s packed economic calendar could deliver the necessary spark for drastic fund flows

- See Q1’19 forecasts for the Dow, Dollar, Bitcoin and more with the DailyFX Trading Guides.

Dow Jones Breaches 26,000

Last week I highlighted the crossroads at which the Dow Jones traded. Since then, not much has changed from a price perspective and fund flows remain relatively muted. That said, next week’s loaded economic calendar could put an end to the recent calm in fund flows activity.

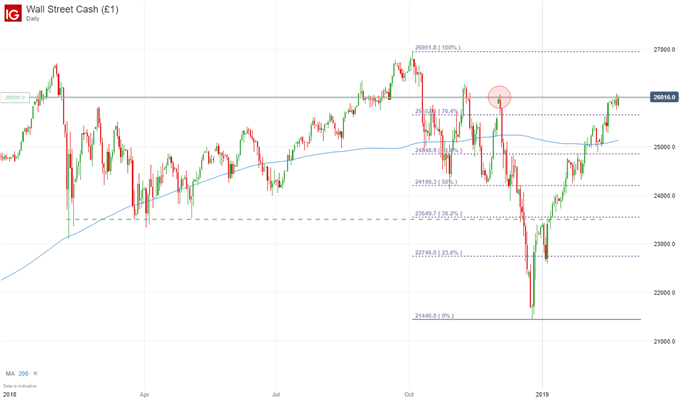

Dow Jones Price Chart: Daily Timeframe (January 2018 to February 2019) (Chart 1)

Learn key tips and strategies to day trade the Dow Jones

February Fund Flows Remain Calmed

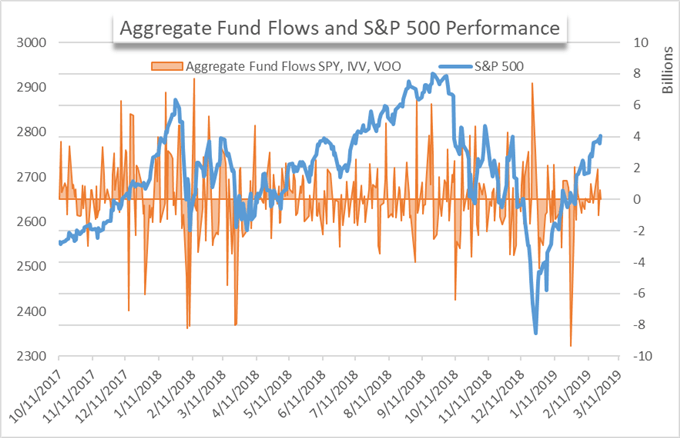

Exchange traded funds SPY, IVV and VOO notched just $373 million in cumulative net inflows this week, with particularly strong buying on Tuesday. While a larger change than last week, the activity still falls short of the record flows witnessed in late January. The relatively deadlocked buying and selling suggests investors are still uncertain about the current landscape of the US equity sector.

Aggregate Fund Flows for Broad Market ETFs versus S&P 500 (Chart 2)

Short-Term Fixed Income Continues to Slide

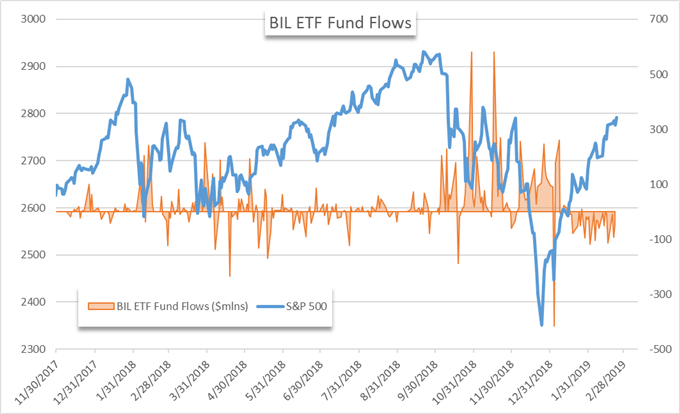

Conversely, investors seem confident about the state of short-term fixed income. The BIL ETF which was also highlighted last week has continued its trend this week. The fund has recorded nearly a month’s worth of consecutive daily outflows. This week alone it saw another $145 million leave its coffers. The reallocation bumps the total capital lost during its streak to nearly $840 million.

BIL ETF Fund Flows (Chart 3)

High Yield Corporate Debt sees Continued Demand

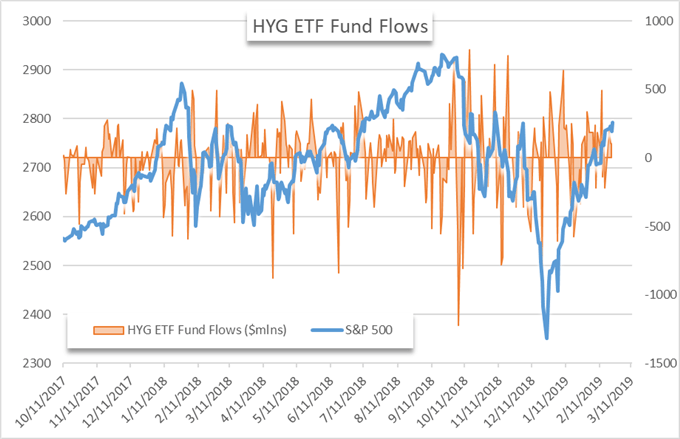

The HYG ETF, a fund that tracks the performance of high yield fixed income, notched another week of net inflows. After over $400 million in inflows this week, the fund has seen roughly $1.2 billion in fresh capital enter the fund. The continued demand for riskier corporate debt suggests some investors are relatively comfortable taking on risk despite the high degree of uncertainty heading into next week.

HYG ETF Fund Flows (Chart 4)

Uncertainty Persists

Despite the nearly unabated rebound for the S&P 500 and Dow Jones, the potential for a risk-off market response is heightened. Combined with a loaded economic calendar from a data perspective, next week will see substantial event risk.

Check out A Brief History of Trade Wars for a crash-course on the background of previous economic conflicts.

Trade wars remain a key factor in the equity space and the ceasefire between the US and China ends next Friday. Should an agreement or extension be reached before then, it buoy sentiment but could also heighten the chances of a trade war in the European Union or Japan. With one trade war front resolved, it would allow the United States to set its sights on a new party.

Elsewhere, a meaningful Brexit vote is scheduled, and Fed Chairman Powell will deliver his semi-annual testimony to a House Panel. View our economic calendar for the other key events that will drive equities next week.

Read more: Stock Markets Await President Trump’s Decision on Auto Tariffs

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.