Fundamental Forecast for USOIL: Bullish

Talking Points:

- Saudi Prince bin Salman throws support behind extension of OPEC+ supply cuts

- Brent Crude rises above $60/bbl for the first time since July 2015

- Per BHI, US Oil Rigs rises by 1; rig count raised to 737 active US oil rigs

- IGCS showing increase in retail short WTI oil positions w/w, contrarian view favors push higher

Oil traders learned this week that Saudi Arabian Crown Prince Mohammed bin Salman of the de facto head of OPEC told markets that he envisioned the energy industry entering a ‘new era.’ Such an era would have the industry lead by similar supply-side controls like the one engaged in by OPEC and select non-OPEC companies like Russia going forward.

Proactive supply-side controls are only being engaged for the Brent Oil contract, the global benchmark as the EIA showed on Wednesday the US continues to gush oil. The EIA Crude Oil inventory report showed US exports rose to the second highest level on record exceeding 1 million per day for the fifth straight week.

While both markets have traded in Bullish fashion since the first week of October, Brent has the clear physical market advantage, and traders understand the imbalance. Brent traded to 27-month highs this week that aligned with a near-record net-long bet by leveraged intuitions. The net-long bias for Brent to WTI crude aligns with the high compliant production curbs in non-US regions while markets remain tired of the near reckless production amounts coming from US shale. Brent is also benefitting from unique geopolitical risks from the Kurdistan oil fields around Baghdad, which makes Brent more susceptible to sharp price spikes should tensions flare.

Curious how the rise in global demand changes the oil market? Access our Q4 forecast on what outcomes we're watching!

The price action on crude oil has been clean after bottoming out in early October. The early October, and thus far, Q4 low happened above prior price resistance before a breakout occurred earlier this year. An inability to attract new selling and see a daily close below the October low of $49.44/bbl for WTI and $55.06/bbl for North Sea Brent that we’ll focus on a Bullish extension.

Crude Oil price expected to hold above $49-51 polarity zone, upside focus for WTI at $56/bbl

Chart Created by Tyler Yell, CMT

Next Week’s Data Points That May Affect Energy Markets:

The fundamental focal points for the energy market next week:

- Monday: Basra Oil, Gas & Infrastructure conference in Beirut

- Tuesday 4:30 PM ET: API weekly U.S. oil inventory report

- Wednesday – Time uncertain: Russia-Iran-Azerbaijan summit in Tehran

- Wednesday 10:30 AM ET: EIA Petroleum Supply Report

- Fridays 1:00 PM ET: Baker-Hughes Rig Count at

- Friday 3:30 PM ET: Release of the CFTC weekly commitments of traders report on U.S. futures, options contracts

Crude Oil IG Client Sentiment Highlight: Contrarian view of retail positioning favors upside

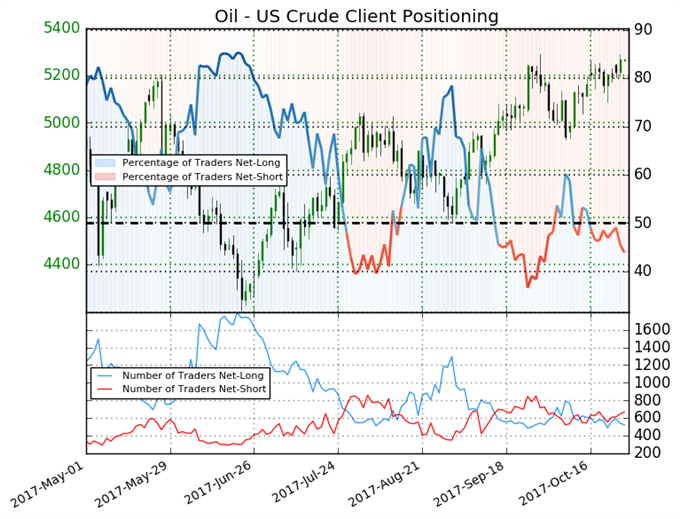

Oil - US Crude: Retail trader data shows 43.9% of traders are net-long with the ratio of traders short to long at 1.28 to 1. The number of traders net-long is 11.0% lower than yesterday and 8.0% lower from last week, while the number of traders net-short is 8.2% higher than yesterday and 8.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil - US Crude-bullish contrarian trading bias(emphasis added).

-TY