Fundamental Forecast for USOIL: Bearish

Talking Points:

- A week after Harvey’s landfall, assessing damage and demand impact still premature

- Last major crises in the region (Katrina 2005) was followed by ~18% drop in Oil

- Per BHI, US Oil Rigs unchanged WoW. Rig count stable at 759 active US oil rigs

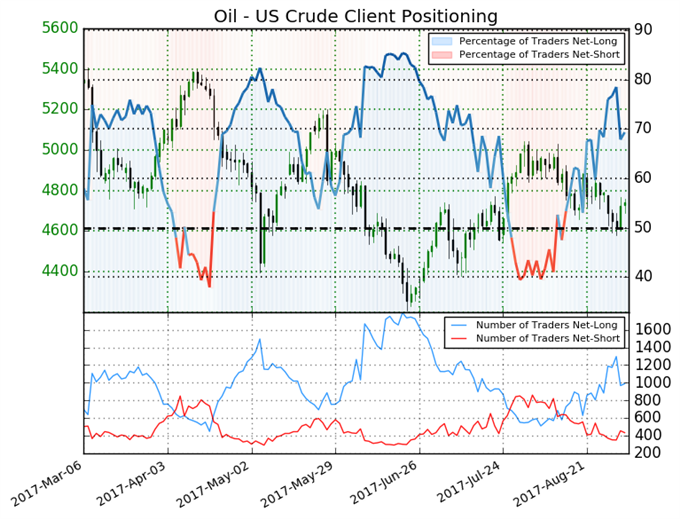

- IGCS showing increase in retail long oil positions, contrarian view favors further price drop

When the Crude Oil market is discussed, typically there is a conversation about the end user demand such as economic growth, and consumption demand with season peaks or the upstream effects. Upstream, which is oil and gas nomenclature for exploration and production, has been of keen interest over the last few years as US output and exporting has been at record levels, and is seen as a key reason why the price of Oil has been hesitant to break above $50/bbl.

Now, concerns are mounting about the refining of crude oil that is closer to the end-user (downstream), which is the refining of oil into usable products like gasoline. The problem is that after Hurricane Harvey, U.S. refining capacity is at a seven-year low, and there remains uncertainty around when the capacity to refine crude, which is still being produced aggressively, could pick up. The largest refiner in the US, Motiva, originally expected to be offline up to two weeks later said there is now no timeline for restarting their refinery in Port Arthur, TX which refines 603,000 barrels per day alone.

In short, Hurricane Harvey has transformed the global market for refined oil products. In addition to refining operations in the energy capital of the US (Houston, TX) remaining shut for an indefinite amount of time, there is an active port in Houston that takes Oil to the world (US exports have been a global dominating factor lately) that is inaccessible, and demand is uncertain. Some could argue the Broken Window Fallacy is good for demand. The theory argues demand is created from destruction, and thus Oil demand would benefit from the needed rebuilding. However, history tends to show that any gains are unevenly dispersed, and the economy as a whole is not better off with stronger demand than before.

Could Hurricane Season alter the outlook for Oil? Click here to see our Q3 forecast on what outcomes we're watching!

Now, on to the charts. We had been watching the price extremes of the recent set of lower highs to anticipate where price will likely move next. This week’s price action on concerns that the downstream components of crude will remain affected caused the price to break below the focal point low of $46.44. The resistance in focus is the pivot before Harvey was seen as the economic disruptor that it has become, which is at last week’s high of $48.13.

A break below the late July low of $45.38 would open up an evidenced back argument for a move to the lower $40/bbl zone where price declines have recently found support. A break above $48.13 would invalidate this view. Until $48.13 is broken, I will now look lower as refinery disruptions by Harvey could continue to put the delivery and demand picture in uncertain waters.

Crude Oil price broker lower after triangulating near trend defining support of $45.38/bbl

Chart Created by Tyler Yell, CMT

Next Week’s Data Points That May Affect Energy Markets:

The fundamental focal points for the energy market next week:

- Saturday: Russia Energy Ministry releases preliminary oil output data for August

- Monday: U.S., Canada Labor Day – Public Holiday

- Wednesday 4:30 PM ET (delayed due to holiday): API weekly U.S. oil inventory report

- Thursday 10:30 AM ET (delayed due to holiday): EIA Petroleum Supply Report

- Friday (Time uncertain): China’s Gerneral Administration of Customs releases August commodity data

- Fridays 1:00 PM ET: Baker-Hughes Rig Count at

- Friday 3:30 PM ET: Release of the CFTC weekly commitments of traders report on U.S. futures, options contracts

Crude Oil IG Client Sentiment Highlight: Contrarian view suggests further drop in price

Oil - US Crude: Retail trader data shows 69.3% of traders are net-long with the ratio of traders long to short at 2.26 to 1. In fact, traders have remained net-long since Aug 14 when Oil - US Crude traded near 4894.0; price has moved 3.1% lower since then. The number of traders net-long is 19.8% lower than yesterday and 4.7% higher from last week, while the number of traders net-short is 15.9% higher than yesterday and 8.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Oil - US Crude trading bias. (emphasis added).

-TY