Fundamental Forecast for USOIL : Bearish

Talking Points:

- Crude Oil trades lower for the third week in as glut expected to be prolonged

- Fundamentals push futures into Contango which pushes front dated contracts lower

- Per Baker Hughes, US Oil Rig count rose 8 to 741, 21st consecutive increase

You would be forgiven for thinking that if a collective group like OPEC that controls ~40% of the world output cut production through 2018 that you expected prices to rise. Many thought that and still do, but in the near term that has not been the case and the United States oil producers seem to be to blame. On Friday, Baker Hughes showed that shale production had increased for the 21st straight week and Wednesday’s EIA numbers showed the largest week-on-week change in new supply since 2008. If demand were strong, this backdrop might be OK, but there are concerns on the demand front as well.

On Wednesday, traders will get a triple whammy of US data points that will further hint as to whether or not US demand has a chance at consuming aggressively produced Oil. The data points on Wednesday are June FOMC (rate hike fully priced in), CPI and retail sales. Of course, Wednesday is also the EIA inventory report that traders will watch in hopes that last week’s production and supply build was an outlier and not the start of a worrisome trend.

When looking at the Futures market, we are seeing fear of the later where supply pressures are set to continue and demand will not be there to meet the demand, which would take prices lower. Traders often look at calendar spreads to see what is expected by the market based on current fundamentals. A recent development is a Contango spread where futures contracts for December are trading at a discount to December 2018 deliver to the tune of ~$1.50, which is the lowest level since late November when OPEC announced the extension. A negative time-spread shows inventory stockpiles are too high and the cost of storage and other factors shows traders will pay more for something in the future (futures spot price) than they will currently pay. Friday’s Contango spread per Bloomberg was the widest levels seen in 2017.

Will US crude producers continue to spoil the best-laid plans and efforts of OPEC for the price of Oil? See our forecast to find out what our top minds think on Crude !

Crude barely holding LT price channel support, breakdown could bring a test of $50/bbl

Chart Created by Tyler Yell, CMT

Next Week’s Data Points That May Affect Energy Markets:

The fundamental focal points for the energy market next week:

- Tuesday ~6 AM ET: OPEC Monthly Oil Report

- Tuesday 4:30 PM ET: API weekly U.S. oil inventory report

- Wednesday 10:30 AM ET: EIA Petroleum Supply Report

- Wednesday 2:00 PM ET: FOMC rate decision

- Fridays 1:00 PM ET: Baker-Hughes Rig Count at

- Friday 3:30 PM ET: Release of the CFTC weekly commitments of traders report on U.S. futures, options contracts

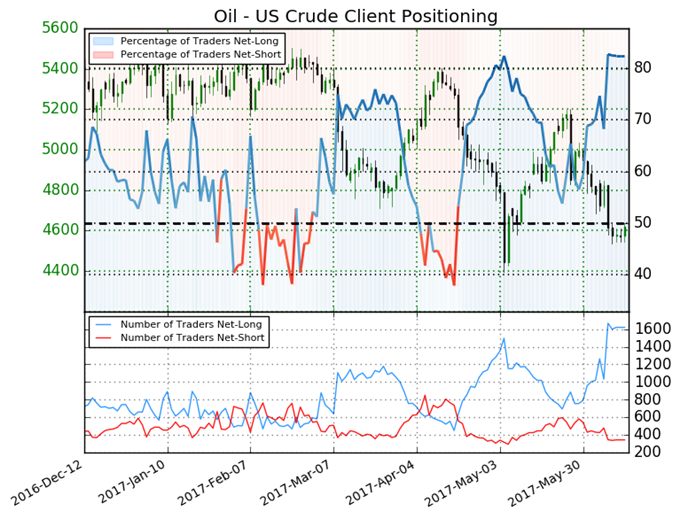

Crude Oil IG Client Sentiment Highlight: Contrarian view favors further Bearish pressure

Oil - US Crude: Retail trader data shows 82.3% of traders are net-long with the ratio of traders long to short at 4.67 to 1. In fact, traders have remained net-long since Apr 19 when Oil - US Crude traded near 5333.7; price has moved 13.4% lower since then. The number of traders net-long is 6.7% higher than yesterday and 40.4% higher from last week, while the number of traders net-short is 15.4% lower than yesterday and 29.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil - US Crude-bearish contrarian trading bias. (Emphasis mine)

The insight derived from this sentiment analysis on Oil is that traders are jumping on aggressively to the long side of the market. This could be a precedent to a bearish breakout that we will keep you up to date on if price closes below $43.79/bl for the week and is combined with a further rise in net long positions.

-TY