Crude Oil, Canadian Dollar Analysis & News

- OPEC Meeting In Focus

- Production Cut May Not Match with Demand Hit

- Currency Correlation with Oil

OPEC+ Meeting: The sizeable gains in the oil complex has been among the contributing factors behind the recent bid across the equity space. As such, in light of the surge in oil prices, all eyes will be on the upcoming OPEC+ meeting where major oil producers will be looking to provide stabilise the oil market via a coordinated production cut. Consequently, headline risk will be notably elevated for crude futures.

| Change in | Longs | Shorts | OI |

| Daily | -7% | -2% | -5% |

| Weekly | 11% | -23% | -2% |

Production Cut: While reports suggest that a baseline cut has yet to be reached, the touted figure of the size of a production cut had been around 10mbpd. However, a cut of this size would still fall short of the expected hit to oil demand around 20mbpd, which in turn would see oil stockpiles continue to rise. Perhaps more crucially, an agreement on a production cut will becontingent on the participation of the US.

Worst Case Scenario: Much like the prior month, failure to broker an agreement could see Brent crude futures return to the low $20s, particularly with Saudi Arabia likely to retaliate via its May OSP (reminder, this announced has been delayed due to the OPEC+ meeting).

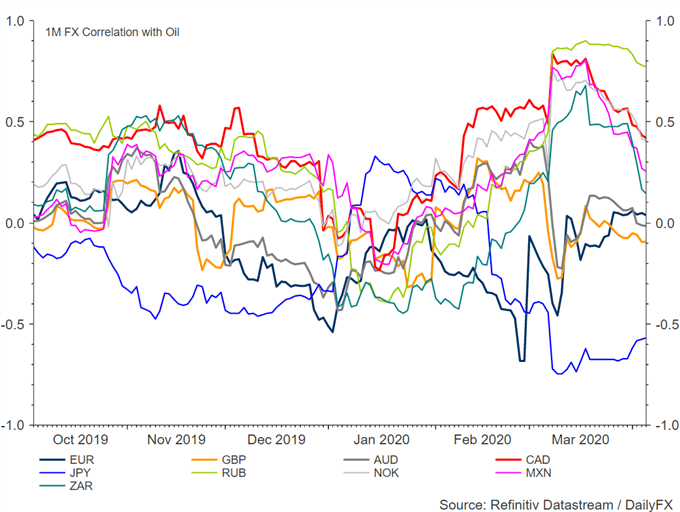

FX Correlation with Oil: With eyes on the upcoming OPEC+ meeting, volatility is expected to pick up in commodity-linked currencies. As shown in figure 1 the Russian Rouble, Canadian Dollar and Norwegian Krone are among the most positively correlated currencies to Brent crude futures (over the past month). Given that the bar is relatively low for disappointment, this leaves commodity-linked currencies vulnerable to a pullback, particularly against the Japanese Yen. That said, we are cognizant that the shorter term 1-week correlation has shown a reduced influence that oil prices have had on commodity-linked currencies with the relationship between the Canadian Dollar and oil relatively flat.

Figure 1. Currency Correlation to Oil Prices

How to Invest During a Recession: Investments & Strategy

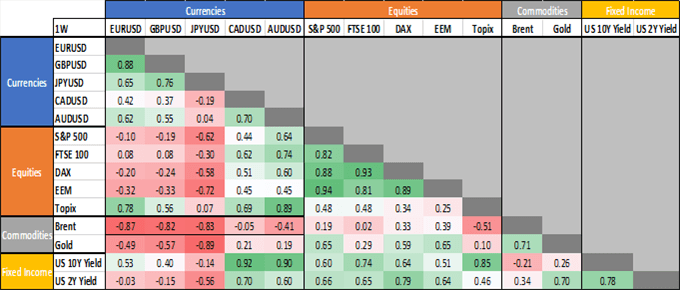

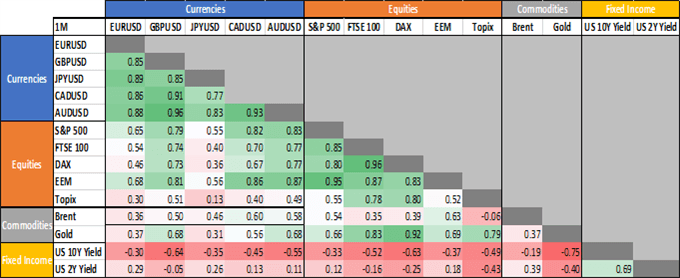

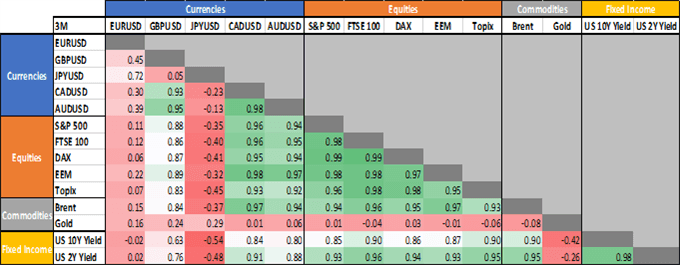

Cross-Asset CorrelationMatrix(1 Week, 1 Month & 3 Month Timeframe)

Source: Refinitiv, DailyFX. The Topix is used a proxy for the Nikkei 225.

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX