Key Highlights:

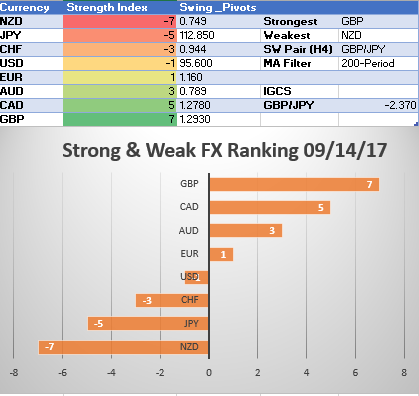

- GBP takes top spot thanks to hawkish BoE

- NZD is currently weakest currency on N.Z. Opposition Labour Party leading polls

- IGCS favors keeping an eye on further GBP strength against weaker FX

Strong Weak Analysis is a way to identify momentum in the FX market. Trend traders rely on spotting and riding momentum as it develops and looks to benefit from trends extending, as many do. It’s also worth noting when the strength of a trend is waning, which Strong Weak analysis can also benefit.

Each day will bring you an index of strong and weak currencies as identified via the methodology in our article, ‘How to Create a "Trading Edge": Know the Strong and the Weak Currencies’. I will also share with you sentiment developments via IG Client Sentiment that can provide additional insight to help you decide what trends could extend.

Strong/ Weak Index: September 14, 2017

Highlights:

-The Bank of England struck a hawkish tone despite weak wage growth with unemployment in the UK the lowest since the mid-1970s. The market is now repricing a Bank of England rate hike into the February 2018, up from the May 2018 meeting. Some banks like Goldman Sachs are looking to a hike later this year. The 10yr Gilt Yield has risen by 20bps this week alone, which helps explain why the GBP has received such a bid.

-The US Dollar has aggressively moved up the rankings as many concerns such as North Korea, the Debt Ceiling, and Hurricanes galore have lessened and a potential hike to finish off 2017 is coming back into the picture. US CPI beat expectations on Thursday, and the question now becomes will the bearishness and pessimism of the US wane or will the longer-term deflationary fears continue the preference to sell now and ask questions later. Friday brings about US retail sales, and a reading over 0.2% m/m would encourage USD bulls further.

-While EUR is moving lower, the longer-term picture appears optimistic. Options traders are placing a premium on longer-term calls (bullish EUR). A one-year premium of calls to puts in EUR has not been seen since 2009. In other words, Draghi’s plea to talk down the EUR is falling on deaf ears or ears that are not fooled about the EUR economic momentum.

-NZ politics are having an impact and causing selling pressure. NZD/USD has fallen by over 1.8% against the GBP. The NZ polls show a bias to the opposition party heading into the election next week.

Interested in DailyFX’s FREE longer-term price forecasts? Click here to access

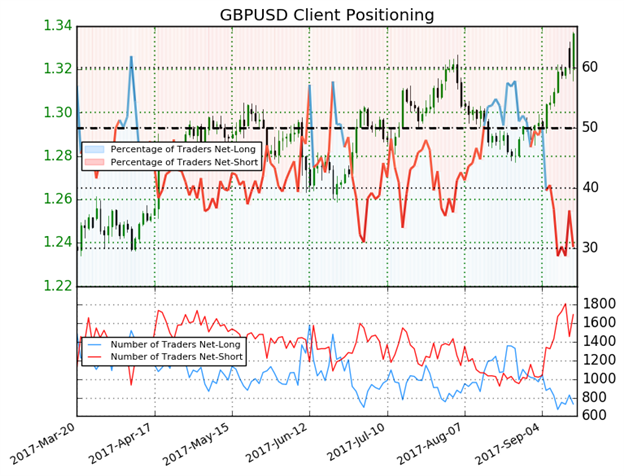

IGCS Highlight: GBP Bears doubt the Hawkish Tilt of the BoE

GBPUSD: Retail trader data shows 30.1% of traders are net-long with the ratio of traders short to long at 2.32 to 1. In fact, traders have remained net-short since Sep 05 when GBPUSD traded near 1.30402; price has moved 2.5% higher since then. The number of traders net-long is 10.0% lower than yesterday and 25.3% lower from last week, while the number of traders net-short is 1.3% lower than yesterday and 24.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bullish contrarian trading bias (emphasis added.)

For a deeper explanation on what’s been shared above, please join the FX Closing Bell Webinar with Tyler Yell

--- Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell