Euro, EUR/USD, EUR/CHF, EUR/GBP Talking Points:

- It’s been a brutal month of February for the Euro.

- The single currency has slid to fresh multi-year lows against a number of currencies.

- Retail traders are continuing to try to call a bottom on the Euro.

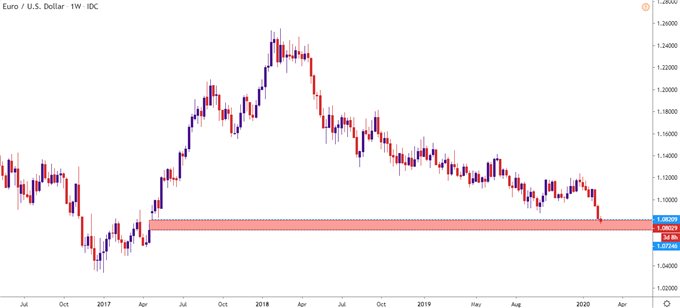

EUR/USD Begins to Fill Gap from April 2017 French Elections

It’s been a brutal month of February in the Euro, particularly in the major pair of EUR/USD. Coming into February, EUR/USD had been caught in a range for the prior four months, holding above the 1.1000 psychological level through numerous tests; most recently on January 29th around the most recent FOMC rate decision.

But when Euro bears came back into the matter around the February open, the 1.1000 support zone could stand in the way no longer; and sellers attacked to push all the way down to a fresh two-year-low, probing below the 1.0878 watermark that had come into play on October first of last year. Sellers have continued that push through the holiday, and EUR/USD is now venturing into some interesting area on the chart as price action has begun to fill a gap that’s been hanging around for almost three years; taken from April of 2017.

That gap came into play because of a market-friendly outcome in French elections, and the single currency continued to rally for the rest of 2017 and the first month-and-a-half of 2018. But as another political risk reared its ugly head, and a risk that has yet to completely dissipate from the equation, Italian elections triggered another bearish run that pushed EUR/USD from a high above 1.2500 down to a key zone of support around the 1.1200 handle.

Last year was abnormally quiet for much of the period in EUR/USD, producing some record-low readings via volatility. There was a downside run that ran from July to September; but through it all, that gap remained on the chart from April of 2017, running from 1.0821 down to 1.0725. As I’ve mentioned numerous times in webinars since, that gap would likely come back into play at some point, and it appears that point is now.

As that gap has begun to fill, retail traders have piled-on in the attempt of calling a bottom in the pair. I had looked into this in the Euro Weekly Technical Forecast, and the fact remains through this week’s open as there are currently three traders long for every one that’s short in the observed study.

| Change in | Longs | Shorts | OI |

| Daily | -17% | 6% | -7% |

| Weekly | -22% | 17% | -8% |

EUR/USD Weekly Price Chart: Welcome Back to the Gap

EUR/USD Remains Oversold – Retail is Trying to Call a Bottom

As looked at in this week’s Technical Forecast on the Euro, retail traders are still trying to call a bottom on the single currency, even with the continued losses that have shown around the Euro. In EUR/USD, there are three traders long for every one short (as of this writing) in the observed study; and given the contrarian nature of retail sentiment, this would point to the potential for further losses in the pair.

Lurking below current price action are two interesting areas of relevance: The 1.0750 psychological level and then 25 pips lower is the end of the gap, or the closing price from April 21st of 2017.

EUR/GBP Tests Key Support

EUR/USD isn’t the only pair where Euro-traders are trying to call a bottom, as a similar backdrop has developed against the British Pound in EUR/GBP. The sentiment read isn’t as extreme, with roughly 71% of retail traders holding long positions in the pair currently but, similarly, this imbalance shows after a sharp downside move has pushed prices down to a key area of support.

| Change in | Longs | Shorts | OI |

| Daily | 33% | -26% | 4% |

| Weekly | 6% | 4% | 5% |

Price action in EUR/GBP is currently testing the 61.8% retracement of the post-Brexit move in the pair, taking the low from June of 2016 and drawing it up to the high set last year. This same price helped to provide support in early-December, just after the bullish launch in the GBP on the back of Brexit-drivers; and the 50% marker from that same study is a case of prior support-turned-resistance.

EUR/GBP is currently testing fresh three-year-lows in the pair, and a break-through the 61.8% Fibonacci level can keep the door open for a move towards the .80-handle; with potential support along the way at .8250 and .8125.

EUR/GBP Weekly Price Chart

EUR/CHF Deep Oversold – But Does it Matter?

Incorporating a bit of political/economic intrigue into the mix and EUR/CHF could remain as interesting. It was just last month that the US Treasury department removed the tag of ‘currency manipulator’ from China; and then promptly placed that title on to Switzerland. To be sure, the Swiss National Bank has been busy over the past decade, accumulating billions of USD worth of global equities. But with the US Treasury department calling out the country for weakening/diluting their currency in the effort of protecting domestic investors, it puts the Central Bank in a precarious spot, raising the question as to whether the SNB would be able to continue to defend the Franc.

In turn, CHF strength has shown quite visibly; and similar to the above scenarios, when taken with this additional Euro-weakness, multi-year lows have begun to show.

From a sentiment perspective, EUR/CHF is even more extreme than either of the above two markets, with almost seven retail traders long for every one that’s short; further keeping the door open for continued losses in the pair.

| Change in | Longs | Shorts | OI |

| Daily | -8% | 7% | -1% |

| Weekly | -18% | 2% | -9% |

EUR/CHF Weekly Price Chart

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX