Canadian Dollar Talking Points:

- The BoC rate decision took place this morning and the Bank of Canada held rates as was widely expected. This leads into the FOMC rate decision scheduled for later today, with all USD-pairs exposed to potential volatilty.

- USD/CAD has started Q4 with a strong bearish trend, pushing prices in the pair down to a confluent zone of support that has since helped to hold the lows. Can USD/CAD sellers break through this large swath of support?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Bank of Canada Holds Rates Steady

The Canadian Dollar has been on the move so far in Q4. And when coupled with a weak US Dollar as the US currency began to reverse in the opening days of the fourth quarter, a strong trend had developed in USD/CAD that pushed the pair very near yearly lows.

At today’s Bank of Canada rate decision, the BoC held rates as was widely-expected. CAD weakness did show up on the back of the statement, however, as the Bank of Canada has grown more cautious around global growth. Taken from this morning’s statement, ‘Growth in Canada is expected to slow in the second half of this year to a rate below its potential.’ The full statement can be read here: Bank of Canada October Interest Rate Decision.

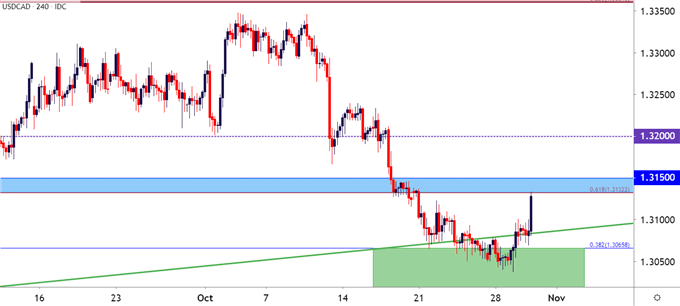

Coming into this week, USD/CAD was sticking to a bearish trend that had pushed the pair down to fresh three-month-lows, with buyers finally stepping in ahead of the July swing sitting just above the 1.3000 psychological level. As looked at in yesterday’s webinar, a pullback to find resistance around prior support, taken from the 1.3132 Fibonacci level, could soon re-open the door for bearish trend strategies, looking for that eventual re-test of the 1.3000 handle.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

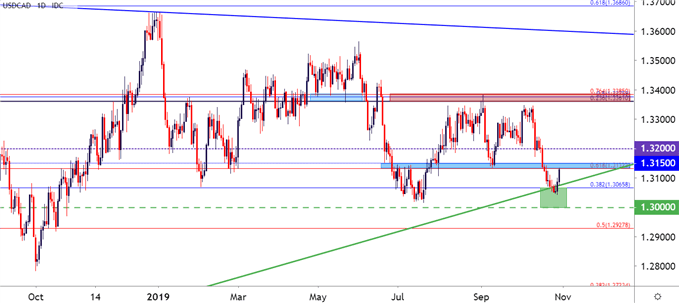

As looked at last week, USD/CAD was nearing a big area of confluent support. And while it took a couple of days for buyers to respond, the fact remains that continuation could still show in that theme after USD/CAD has clawed back a portion of those prior losses.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

This leads into a widely-expected rate cut from the FOMC later today. Markets are pricing in a greater than 95% chance of another rate cut from the Fed but, as has become usual, the big focus will be on what the bank alludes to for near-future monetary conditions. If the FOMC takes on a similar tone of stability as what was shown over the prior two cuts, USD-strength may stick around for a bit as shorts cover. This could further push USD/CAD up to resistance levels around the 1.3200 handle.

In each potential instance, rallies could be attractive for fades, looking for an eventual re-test of the 1.3000 handle at fresh yearly lows, targeting bearish breakout potential.

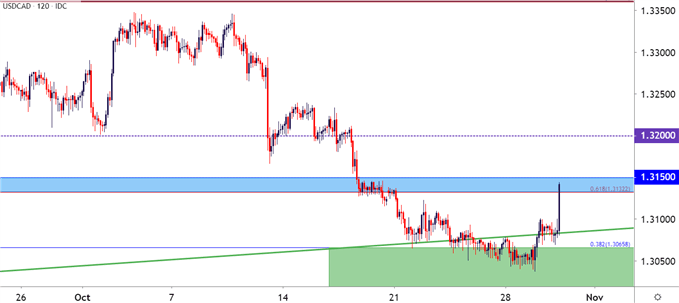

USD/CAD Two-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX