- GBP expected range on Thursday near 450 pips depending on how Carney leans

- Market looks through FOMC and on to Thursday’s Fed Chair appointment

- IGCS favors keeping an eye on GBP strength against USD

Will they or won’t they? That is, will the Bank of England on Thursday signal subsequent hikes? The market is pricing in an 88% probability of a rate hike on Thursday. However, the anticipated volatility surrounds whether or not the BoE’s Mark Carney will provide the scenario where GBP/USD moves toward 1.3350 on a hawkish take-away (more hikes to come) or toward 1.2900 if Carney sounds a dovish tone (one-and-done.)

While Wednesday’s top event will technically be the Federal Reserve rate announcement (markets pricing in less than 1% probability of a move), all eyes are one day forward where US President Donald Trump is expected to appoint the next Fed chair. Current front-runner Jerome Powell is seen as a complement to the Yellen viewpoint, and Powell would not be seen rocking the boat of monetary policy. The market is pricing in an 85% chance of a rate hike in December, and after the FOMC chair nomination is made known, traders will likely look for ways to continue playing the USD rebound from the 2017 trend.

Interested in an AUD/USD trading idea, click here to access

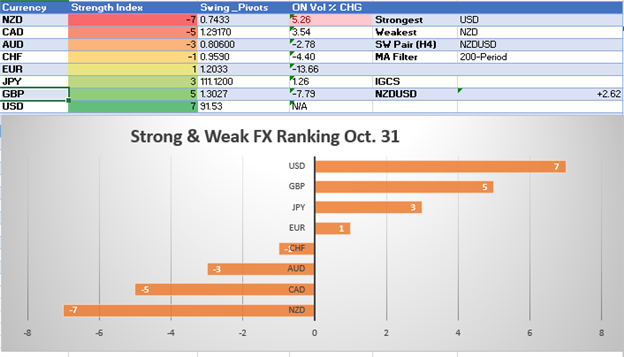

As mentioned yesterday, traders should continue to keep an eye on commodity currencies that continue to sell-off. On Tuesday, New Zealand Prime Minister Jacinda Ardern said foreign speculators would no longer be able to buy NZ houses for speculative purposes, which adds to the political risk premium that has taken NZD down by 3.5% over the last month. On Tuesday, the Canadian Dollar also weakened after GDP missed estimates.

Access our trading guides to help you develop your trading strategy

Strong/ Weak Index October 31, 2017

Chart created by Tyler Yell, CMT

Interested in DailyFX’s FREE longer-term price forecasts? Click here to access

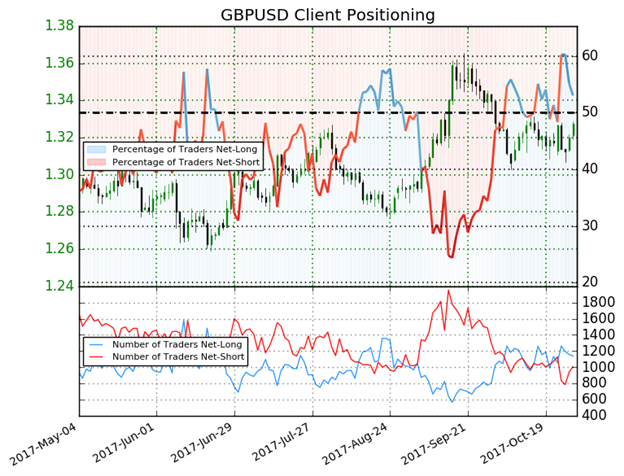

IGCS Highlight: GBP strength may arise as ST retail bearishness is on the rise

GBPUSD: Retail trader data shows 53.0% of traders are net-long with the ratio of traders long to short at 1.13 to 1. The number of traders net-long is 12.7% lower than yesterday and 7.1% lower from last week, while the number of traders net-short is 12.5% higher than yesterday and 5.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse higher despite the fact traders remain net-long (emphasis mine.)

For a deeper explanation on what’s been shared above, please join the FX Closing Bell Webinar with Tyler Yell

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell