Would you like to know what our top minds are watching over the long-term in markets?

Talking Points:

- Premium of USD borrowing continues to fall (DXY bearish)

- EUR/USD climbs to fresh 2017 high as ECB warns of imminent shift in monetary policy

- Sentiment Highlight: USD/CHF breakdown bought by retail crowd, contrarian bearish signal

Dollar charts turned a brighter shade of red on Tuesday as the Dollar Index (DXY) broke below a 3-year uptrend line drawn from the 2014 low. As with most charts, the story behind the price is worth discussing, and USD weakness is no exception. In short, we’ve seen the hope for an aggressively tighter Federal Reserve on what was presumed to be expansionary fiscal policy dissipate for most of 2017. The combination of relatively restrictive monetary policy as Trump’s fiscal plans were revealed to lead the USD ever-higher, but that has not been the case.

There are a few markets that you could look to for evidence of falling concern about USD strength. Two markets that we’ve looked at in the recent past are 25-delta (fancy option talk), which shows options traders are not paying to protect against aggressive USD upside like they had been in months past and Eurodollar futures. Eurodollar futures or EDA’s is a market that allows companies and speculators to see and mitigate the cost (i.e., interest rate) to hold dollars in an offshore account via USD LIBOR over 90-days. Sounds boring, doesn’t it? Well, it’s difficult to know the size because the Eurodollar futures market is unregulated but Eurodollar trading at the CME involves more contracts than S&P futures, Oil futures, & 10yr bond futures or TY1. In short, Eurodollars are a giant deal, and the market provides a way for us to see what the providers of liquidity to the global financial system expect of future interest rates. Recently, the EDA price has trended higher toward 2017 highs.

A Eurodollar move higher, which we’ve seen, suggests that it will cost less to borrow USD internationally and it will pay less to lend USD per the view of the banks the price it out, which aligns with the weakness recently seen in USD via the DXY. While there are often more factors that determine a currency’s strength or weakness than many investors give credit, the rise in Eurodollars through December help show why EUR/USD is moving toward 1.12 with what appears to be little resistance. On the other side of the equation, we have seen European economic data support the view from the ECB that monetary policy could soon shift to a more restrictive stance, which would likely reduce the spread between European core bond yields and US yields further. A flattening of the yield spread between European core yields and US yields has been correlated with EUR/USD appreciation for much of 2017.

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

Would you like to see what our Analysts forecast for EUR longer-term? Find out here !

Closing Bell’s Top Chart: May 16, 2017, DXY breaking below uptrend line from 2014 low

Tomorrow's Main Event: Euro-Zone Consumer Price Index (MoM) (APR) (Final Print)

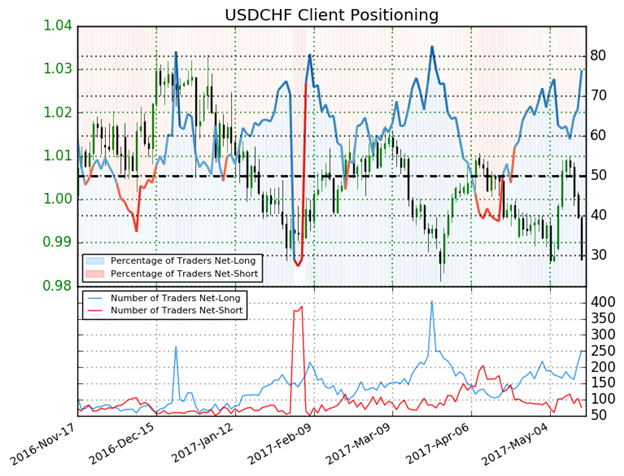

IG Client Sentiment Highlight: USD/CHF Net-Longs Increase by 46.5% WoW, Contrarian Sell Signal

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

.

USDCHF: Retail trader data shows 76.6% of traders are net-long with the ratio of traders long to short at 3.27 to 1. In fact, traders have remained net-long since Apr 21 when USDCHF traded near 0.99754; theprice has moved 1.1% lower since then. The percentage of traders net-long is now its highest since Mar 20 when USDCHF traded near 0.99878. The number of traders net-long is 40.0% higher than yesterday and 46.5% higher from last week, while the number of traders net-short is 26.7% lower than yesterday and 20.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCHF prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCHF-bearish contrarian trading bias.(Emphasis Mine)

The aggressive rise in net-long positioning on a week-on-week basis in USD/CHF places doubt on a sustainable move higher despite the hope of traders.

Learn more about how to use IG Client Sentiment in your trading here.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell