Canada GDP Report Overview:

- The June Canada GDP report is due out on Friday, August 30 at 12:30 GMT, but the data aren’t likely to trigger a significant shift in BOC rate odds.

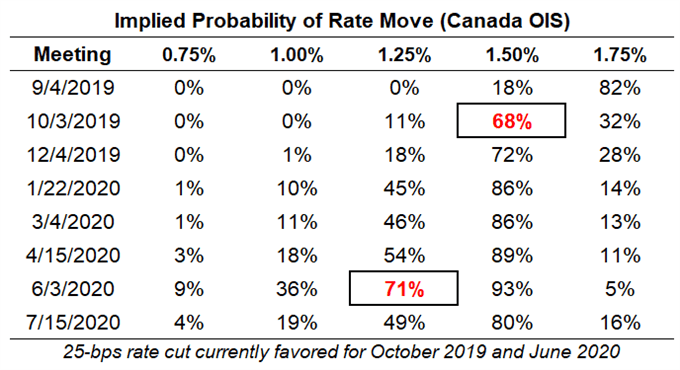

- Overnight index swaps are currently pricing in a meager 18% chance of a 25-bps rate cut at the September BOC meeting, while there is a 68% chance of a 25-bps rate cut at the October BOC meeting.

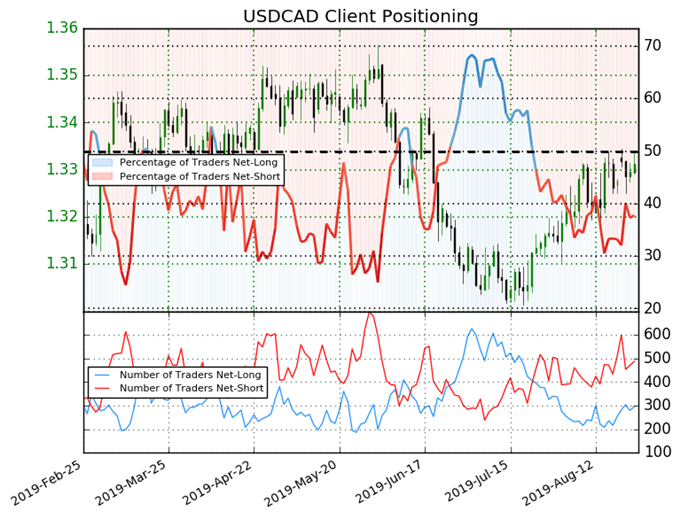

- Retail traders have remained net-short since July 23 when USDCAD traded near 1.30537; price has moved 2.0% higher since then.

Join us on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

08/30 FRIDAY | 12:30 GMT | CAD GROSS DOMESTIC PRODUCT (JUN)

The June Canada GDP report doesn’t appear like to will motivate Bank of Canada policymakers to act any faster than rates markets are currently pricing in as central banks around the world join the “race to the bottom.” Year-over-year growth is due in at 1.4%, the same pace in May; the monthly rate is due to moderate to 0.1% from 0.2%.

There is a strong argument to be made that, but for deteriorating global economic conditions, the Canadian economy may be doing better than the current middling rate of growth. Looking at data trends in June, the Citi Economic Surprise Index for Canada gained from 119 to 139.6. On balance, continued improvement among domestic factors may offset rising issues among external factors.

Bank of Canada Interest Rate Expectations (August 23, 2019) (Table 1)

Even though Canadian economic data has rebounded over the past week (the Surprise Index is now at 70.6, up from the yearly low of 8.4 on August 19), concerns over global growth have provoked the Bank of Canada into a more cautious policy stance. Overnight index swaps are discounting a 68% chance of a 25-bps rate cut in October and a 71% chance of a second 25-bps rate cut over the next 12-months coming in June 2020.

Pairs to Watch: CADJPY, EURCAD, USDCAD

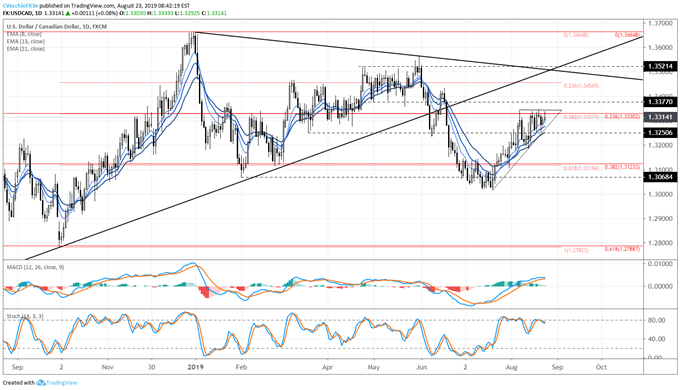

USD/CAD Technical Analysis: Daily Price Chart (September 2018 to August 2019) (Chart 1)

USDCAD prices continue to coil in a symmetrical triangle, as they have over the course of the month of August. Despite a breakdown in short-term correlations, the path of least resistance for USD/CAD remains higher if crude oil prices are going to struggle further. Price continues to linger below resistance near the 23.6% retracement from the September to December 2018 high/low range as well as the 38.2% retracement of the 2018 high/low range around 1.3225/30.

With USD/CAD continuing to trade above the daily 8-, 13-, and 21-EMA envelope, daily MACD continuing to rise in bullish territory and Slow Stochastics holding near overbought territory, the path of least resistance remains to the topside.

IG Client Sentiment Index: USD/CAD Price Forecast (August 23, 2019) (Chart 2)

USDCAD: Retail trader data shows 37.8% of traders are net-long with the ratio of traders short to long at 1.65 to 1. In fact, traders have remained net-short since July 23 when USDCAD traded near 1.30537; price has moved 2.0% higher since then. The number of traders net-long is 2.6% lower than yesterday and 22.3% higher from last week, while the number of traders net-short is 5.9% higher than yesterday and 4.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX