July Australia Jobs Report Overview:

- The July Australia jobs report (employment change and unemployment rate) is due on Thursday, August 15 at 01:30 GMT, and consensus forecasts are looking for the jobs expansion to hit 12 consecutive months.

- AUDUSD fell to a fresh yearly low last week, and it’s too soon to rule out another attempt at a break lower.

- Retail traders have remained net-long since July 19 when AUDUSD traded near 0.7010; price has moved 3.2% lower since then.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

08/15 THURSDAY | 01:30 GMT | AUD EMPLOYMENT CHANGE & UNEMPLOYMENT RATE (JUL)

Even as the US-China trade war rages on, the Australian economy continues to weather the storm between its two largest trading partners. The Australian economy has added jobs for 11 consecutive months, even though last month’s report was rather disappointing a net 471 jobs. Meanwhile, the unemployment rate has been on hold at 5.2% for three consecutive months.

According to a Bloomberg News survey, July will make it 1months in a row with positive jobs growth. Australian employment is due to have increased by 14K last month, and for the fourth consecutive month, the unemployment rate is set to hold at 5.2%.

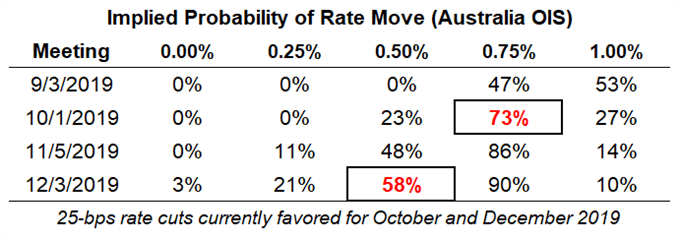

Reserve Bank of Australia Interest Rate Expectations (August 9, 2019) (Table 1)

Despite a dramatic 50-bps by its southern neighbor in the Reserve Bank of New Zealand in August, rates markets still don’t see the Reserve Bank of Australia cutting rates until October 2019. But that doesn’t mean a bit more tumult on the US-China trade war front can’t provoke action sooner; there is a 47% chance of a 25-bps rate cut at the September RBA meeting.

Pairs to Watch: AUDJPY, AUDNZD, AUDUSD

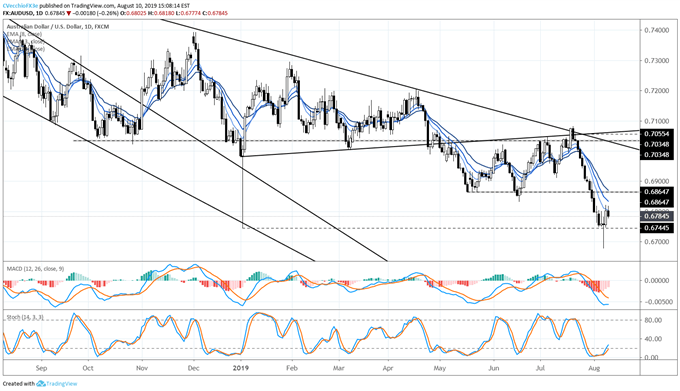

AUDUSD Technical Analysis: Daily Timeframe (August 2018 to August 2019) (Chart 1)

In our last AUDUSD technical forecast, it was noted that “the path of least resistance remains to the downside…Traders may see AUDUSD’s yearly low challenged, set on January 3 around the Yen flash-crash, at 0.6745 over the coming sessions.” Indeed, a fresh yearly low was established since then, with AUDUSD falling as low as 0.6677.

Despite the rebound in recent days, the path of least resistance indeed remains to the downside. AUDUSD traded higher into, but was rejected, by the daily 8-EMA, and is still comfortably below its daily 8-, 13-, and 21-EMA envelope. Daily MACDcontinues to trend lower;meanwhile, Slow Stochastics are still below their neutral line, even if the indicator has started to rise out of oversold territory. Until the daily 8-EMA is breached – AUDUSD has closed below it every session since July 24 – there is little reason to look higher.

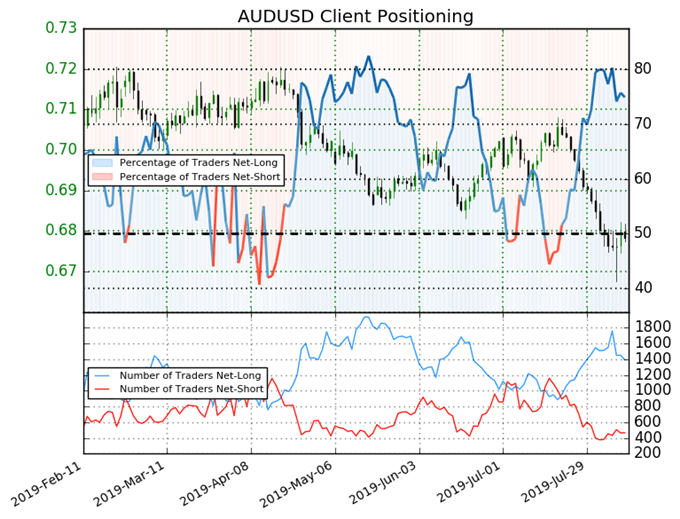

IG Client Sentiment Index: AUDUSD Rate Forecast (August 9, 2019) (Chart 2)

AUDUSD: Retail trader data shows 74.9% of traders are net-long with the ratio of traders long to short at 2.99 to 1. In fact, traders have remained net-long since July 19 when AUDUSD traded near 0.7010; price has moved 3.2% lower since then. The number of traders net-long is 6.5% lower than yesterday and 7.9% lower from last week, while the number of traders net-short is 5.1% lower than yesterday and 26.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUDUSD price trend may soon reverse higher despite the fact traders remain net-long.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX