EURUSD COULD OSCILATE ON JULY US JOBS REPORT NEXT WEEK

- EURUSD faces significant event risk next week with the upcoming July US Jobs Report set to round off the chalk-full economic calendar

- July US nonfarm payrolls data threatens to exacerbate spot EURUSD price action or could cause the currency pair to whipsaw depending on Eurozone GDP and the July Fed meeting earlier in the week

- Another robust labor market report out of the US could cause a sharp repricing of Fed rate cut bets

08/02FRIDAY | 12:30 GMT | USD Change in Nonfarm Payrolls & Unemployment Rate (JUL)

Despite the serious risk faced by spot EURUSD early next week surrounding Q2 Eurozone GDP and the July Fed meeting on deck for Wednesday, the July US jobs report slated for Friday at 12:30 GMT should not be overlooked. Markets should expect the headline change in nonfarm payrolls figure for July to come in at 169K additions according to Bloomberg’s economist survey. This compares to 224K additions in June and 72K added jobs in May.

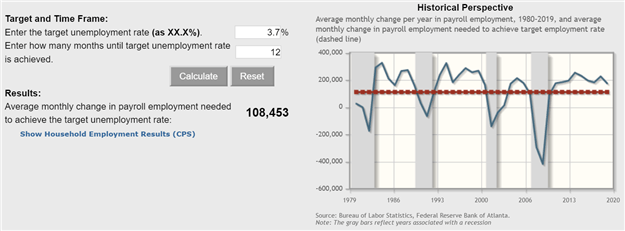

Judging by the Atlanta Fed Jobs Calculator, the US economy needs to add 108.5K jobs per month over the next year in order to maintain the unemployment rate (U3) at 3.7% over that time horizon. Another red-hot US jobs report could put the Federal Reserve’s anticipated dovish monetary policy shift into question and solidify the expected July FOMC rate cut as a one-and-done ‘insurance cut.’ If true, a sharp repricing of lofty Fed rate cut bets could be expected to push spot EURUSD on the path toward printing fresh year-to-date lows.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

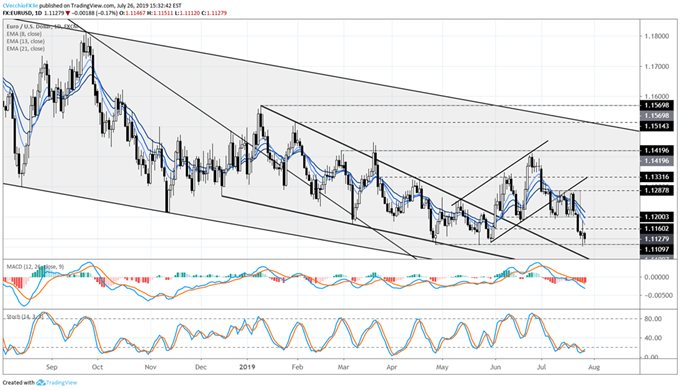

SPOT EURUSD TECHNICAL ANALYSIS: DAILY PRICE CHART (AUGUST 2018 TO JULY 2019)

While the July ECB meeting met expectations by providing a great deal of volatility but not much direction (per the weekly trading forecast), by the end of the week a further retrenchment in Fed rate cut odds had provoked another upswing in the US Dollar, dragging down EURUSD in the process.

Even though price action on Friday produce an inside bar relative to what was seen on Thursday, momentum is increasingly bearish. Price is holding below the daily 8-, 13-, and 21-EMA envelope after briefly establishing a fresh yearly low around the July ECB meeting. Daily MACD continues to dive deeper into bearish territory, while Slow Stochastics are comfortably nestled in oversold condition – a sign of a weak market.

As the calendar turns through the end of July and into the beginning of August, the current EURUSD technical outlook remains bearish, and traders should be on alert for a move to fresh yearly lows over the coming sessions – particularly if we see a one-two punch of a less dovish than expected July Fed meeting and a better than expected July US Nonfarm Payroll report.

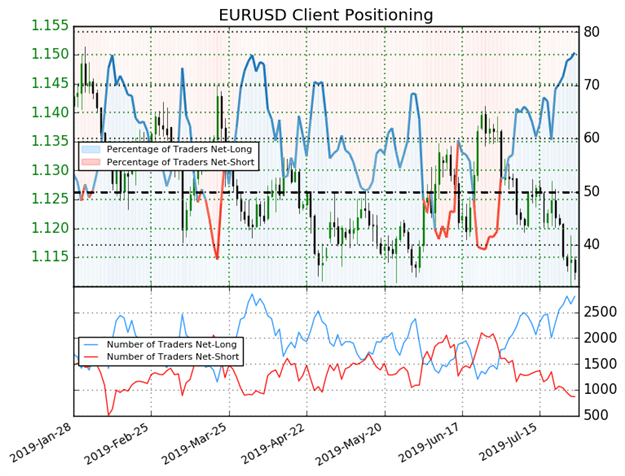

IG CLIENT SENTIMENT INDEX: EURUSD PRICE CHART (JANUARY 28, 2019 TO JULY 26, 2019)

Spot EURUSD retail trader data shows 76.2% of traders are net-long with the ratio of traders long to short at 3.2 to 1. In fact, traders have remained net-long since Jul 01 when spot EURUSD traded near 1.13685; price has moved 2.1% lower since then. The number of traders net-long is 4.2% higher than yesterday and 20.0% higher from last week, while the number of traders net-short is 10.0% lower than yesterday and 24.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

FOREX TRADING RESOURCES

- Download the Q3 DailyFX Forecasts for comprehensive fundamental and technical analysis on major currencies like the US Dollar and Euro in addition to equities, gold and oil

- Sign up for Live Webinar Coverage of the financial markets hosted by DailyFX analysts where you can have all your trading questions answered in real time

- Find out how IG Client Sentiment data can be used to identify potential forex trading opportunities

-- Written by Christopher Vecchio, CFA, Senior Currency Strategist & Rich Dvorak, Junior Analyst

Connect with @CVecchioFX and @RichDvorakFX on Twitter for real-time market insight