ECB Meeting Talking Points:

- The June European Central Bank rate decision and policy meeting will arrive on Thursday, June 6 at 11:45 GMT.

- Ongoing soft PMI readings and eroding inflation expectations have raised the odds of the ECB taking dovish policy actions this week – but that much is already expected by FX markets.

- Recent changes in retail trader positioning suggest that EURUSD could trade higher in the coming days.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

06/06 THURSDAY | 11:45 GMT | EUR European Central Bank Rate Decision

The European Central Bank meets this week to try and shore up investor confidence. With regional PMI readings stumbling and Eurozone inflation expectations sliding lower over the past several months, calls have grown for the ECB to take more substantive action at its June rate decision and policy meeting; the timing is primarily because new Staff Economic Projections will be released this week as well.

For the staff economic projections, traders should be expecting cuts to both the 2020 CPI and GDP forecasts, as well as a potential cut to the 2021 forecasts. The inflation outlook will be particularly interesting, insofar as inflation expectations have plummeted and such events have historically coincided with fresh stimulus from the ECB.

While new stimulus is unlikely this coming week, that is solely due to the previously announced TLTRO3 program which has yet to see its details fleshed out yet. The context of disappointing economic trends otherwise may mean that this is now the opportune time for the ECB to provide clarity here, thereby helping insulate markets. If so, the Euro may not see much weakness around the ECB on Thursday.

Pairs to Watch: EURGBP, EURJPY, EURUSD

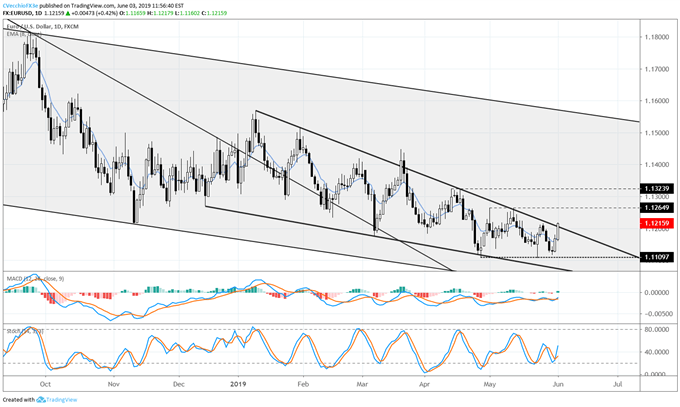

EURUSD Technical Analysis: Daily Price Chart (September 2018 to June 2019) (Chart 1)

When we last gave a technical overview of EURUSD, it was noted that “since bottoming out on April 26, EURUSD prices have been trading sideways between 1.1110 and 1.1265, with the May 1 high established after Fed Chair Powell spoke at the May Fed meeting press conference.” We’ve yet to see a close outside of this range in the past several weeks, although the time for a breakout may be fast approaching.

The EURUSD price forecast may be shifting to bullish as the downtrend from the January, February, April, and May 2019 highs appears ready to give way to a topside move. From a certain perspective, EURUSD prices have been consolidating in a bullish falling wedge since the start of December 2018, which would suggest that a bottoming effort is indeed in process.

If a turn is developing, EURUSD prices will need to clear out more than just the 2019 downtrend. Ideally, bulls would see EURUSD price clear out 1.1265 – the May 1 around the Fed meeting and Fed Chair Powell’s press conference – establishing a new trend of higher highs in the process.

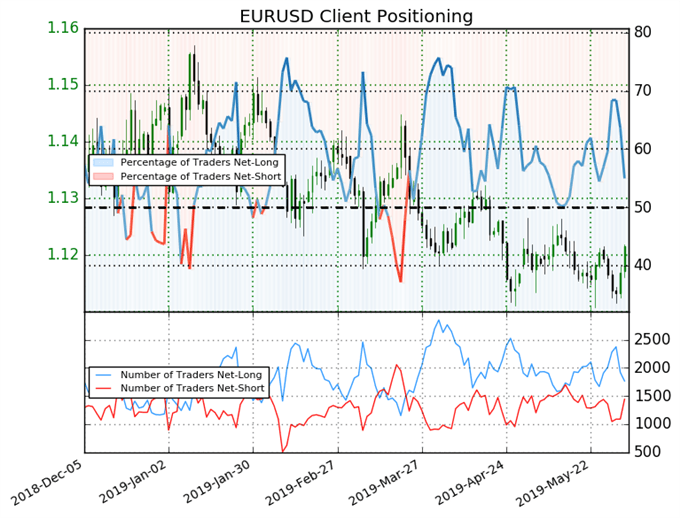

IG Client Sentiment Index: EURUSD (June 3, 2019) (Chart 2)

EURUSD: Retail trader data shows 55.0% of traders are net-long with the ratio of traders long to short at 1.22 to 1. In fact, traders have remained net-long since May 15 when EURUSD traded near 1.1231; price has moved 0.1% lower since then. The number of traders net-long is 13.7% lower than yesterday and 4.4% lower from last week, while the number of traders net-short is 36.4% higher than yesterday and 6.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX