Talking Points:

- The May Fed meeting will conclude on Wednesday, May 1 at 18:00 GMT.

- At the March Fed meeting, policy officials cited an uncertain growth environment as a reason to push back expectations for a rate hike in 2019.

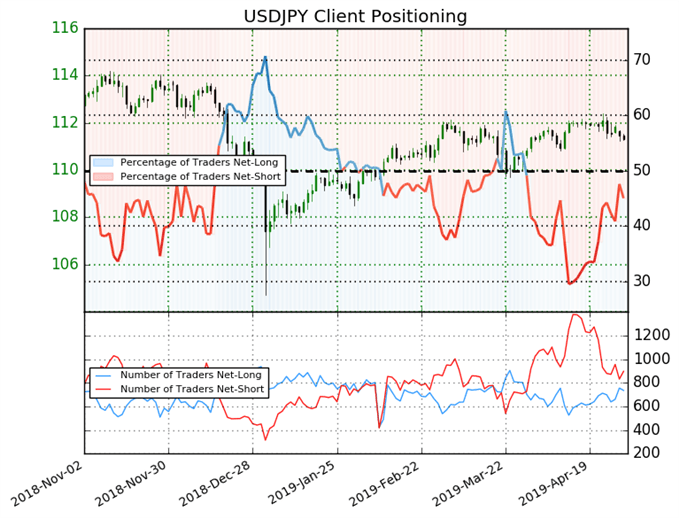

- Retail traders are net-short USDJPY but recent changes give us a bullish USDJPY trading bias.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

05/01 WEDNESDAY | 18:00 GMT | USD FEDERAL RESERVE RATE DECISION

The Federal Reserve meets on Wednesday for its May meeting, and both economic and market conditions couldn’t be more different than when the FOMC last met. In March, concerns were running rampant that the US government shutdown was going to have a significant negative impact on Q1’19 US GDP, which at this point in time, we know was overblown: 3.2% annualized growth was reported last week.

Similarly, with the US jobs market still strong – the unemployment rate is at 3.8% while wage growth is 3.2% y/y – there is a possibility that the FOMC comes out with a more hawkish tone than what was previously deployed. If so, rates markets are potentially leaning too dovish ahead of Wednesday.

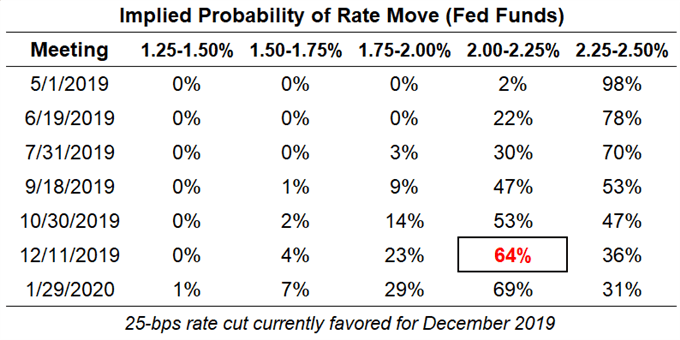

Ahead of the May Fed meeting, rates markets are expecting rates to stay on hold through the first half of the year; however, by October, rates markets begin to favor a rate cut. Given that the Federal Reserve typically changes policies at meetings with a new Summary of Economic Projections, we interpret the above table to mean that a 25-bps rate cut is currently favored for December 2019.

Pairs to Watch: EURUSD, USDJPY, Gold, DXY Index

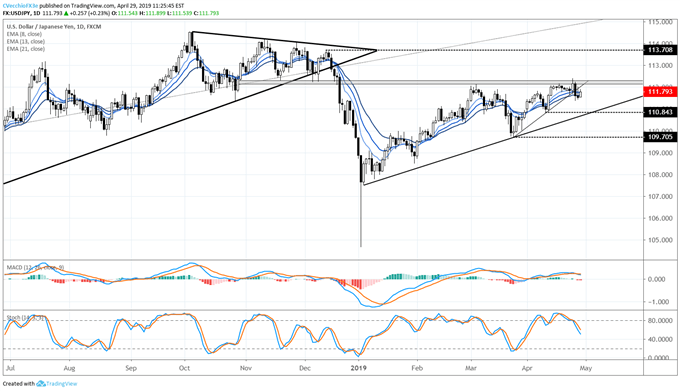

USDJPY Price Chart: Daily Timeframe (July 2018 to April 2019) (Chart 1)

USDJPY prices may have lost the uptrend from the March and April swing lows by the end of last week, but that doesn’t mean that bulls are ready to throw in the towel just yet. And, if the May Fed meeting is going to produce a relatively more hawkish tone, USDJPY may still have room to run higher.

As has been the case since early-March, USDJPY once again failed to close back above the 112.15/30 resistance zone, formerly support through November and December 2018. A move through this area would open the possibility for a return back to the December 2018 swing high near 113.70.

If USDJPY prices are to resolve themselves to the downside, the first level to clear out is the April swing low at 110.84, which would also constitute a break of the uptrend from the post-Yen flash crash low in January.

IG Client Sentiment Index: USDJPY (May 1, 2019) (Chart 2)

USDJPY: Retail trader data shows 45.0% of traders are net-long with the ratio of traders short to long at 1.22 to 1. In fact, traders have remained net-short since Mar 31 when USDJPY traded near 110.5; price has moved 0.7% higher since then. The number of traders net-long is 4.0% higher than yesterday and 2.9% higher from last week, while the number of traders net-short is 4.9% lower than yesterday and 21.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDJPY prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDJPY price trend may soon reverse lower despite the fact traders remain net-short.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX