Talking Points:

- The March Canadian Employment Change report is due on Friday at 12:30 GMT.

- Markets are expecting the Canadian labor market to cool off after exceptionally strong gains in January and February.

- Retail traders have started buying the Canadian Dollar, with USDCAD net-shorts having risen in recent days.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

04/05 FRIDAY | 12:30 GMT | CAD Employment Change & Unemployment Rate (MAR)

The first two months of the year have produced strong labor market reports for the Canadian economy, and as a result, markets are anticipating a quieter March. The January employment change was 66.8K jobs, while the topline February reading came in at 55.9K.Even though the Bloomberg consensus calls for the March report to only show 10K jobs added,the unemployment rate is due to stay on hold at 5.8%. With energy markets continuing their rebound since the start of the year – nearly 11% of the Canadian economy is tied to oil – it’s likely that jobs growth remained positive in Canada through the end of Q1’19.

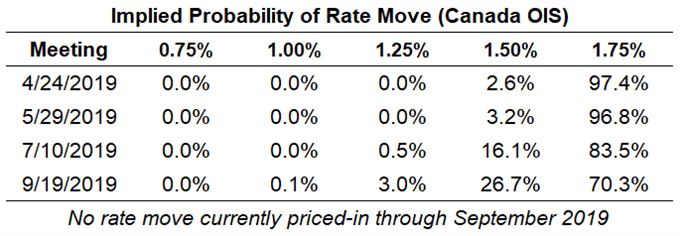

The ongoing improvement in Canadian economic data has given traders pause over dragging forward rate expectations any further. In mid-March, the odds of a 25-bps rate cut were priced-in at 28%; currently, they reside at 26.7%.

Pairs to Watch: CADJPY, EURCAD, USDCAD

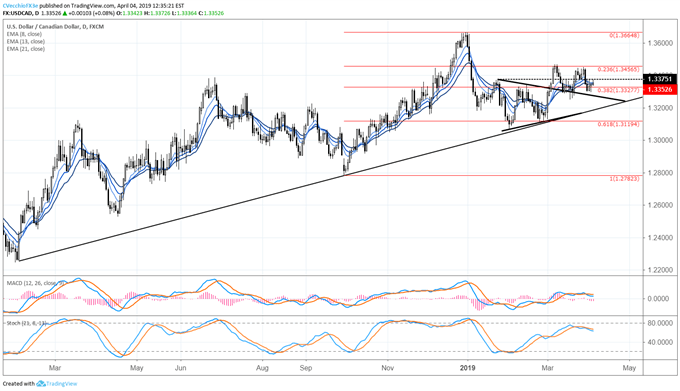

USDCAD Price Chart: Daily Timeframe (December 2018 to April 2019) (Chart 1)

The better than expected January Canadian GDP report has helped keep USDCAD in check, despite broad advances by the DXY Index overall. In turn, the path of least resistance pointing to the topside proved false. As such, if there is one currency on the ready to take advantage of US Dollar weakness, it may be the Canadian Dollar – particularly as oil prices stay elevated.

A double top pattern may be forming with respect to the two March swing highs, and there is evidence that momentum is shifting to the downside. Not only have both daily MACD and Slow Stochastics turned lower, USDCAD price is now below its daily 8-, 13-, and 21-EMA envelope. A move down towards the March low near 1.3251 is possible; bulls would retake control back above the 23.6% retracement of the Q4’18 low to Q1’19 high range at 1.3457. In between, look for more choppy price action like seen over the past month.

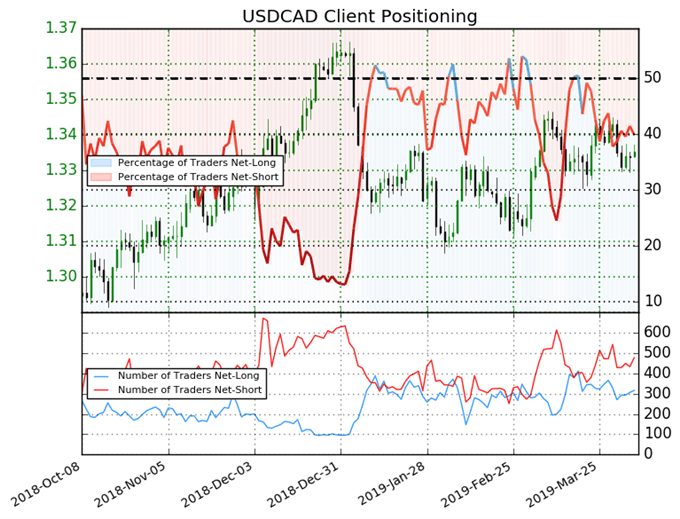

IG Client Sentiment Index: USDCAD (April 4, 2019) (Chart 2)

Retail trader data shows 39.8% of traders are net-long with the ratio of traders short to long at 1.51 to 1. In fact, traders have remained net-short since Mar 22 when USDCAD traded near 1.33698; price has moved 0.1% lower since then. The number of traders net-long is 15.3% lower than yesterday and 12.2% lower from last week, while the number of traders net-short is 18.4% higher than yesterday and 10.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX