Talking Points:

- The preliminary February US Durable Goods Orders report is due out on Tuesday at 12:30 GMT.

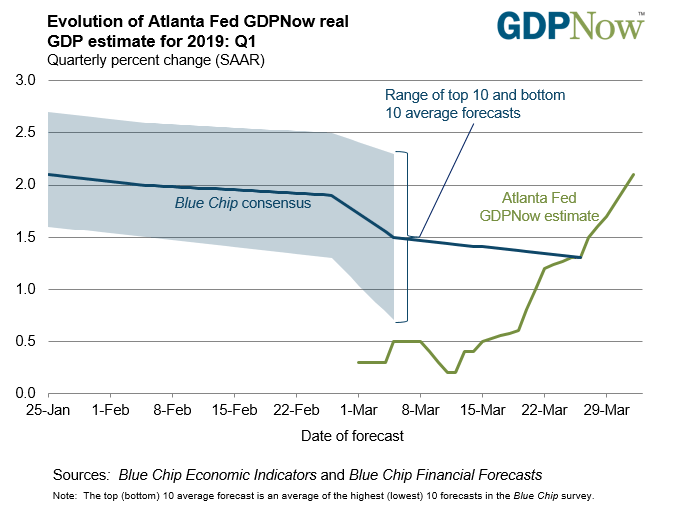

- Q1’19 US GDP expectations continue to rebound after bottoming out at 0.2% in the second week of March; the Atlanta Fed GDPNow estimate is up to 2.1%.

- Retail traders continue to fade US Dollar gains.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

04/02 TUESDAY | 12:30 GMT | USD Durable Goods Orders (FEB P)

Durable Goods Orders are an important barometer for US consumption, which constitutes roughly 70% of GDP. Typically, consumers hold off on buying durable goods during poor economy conditions; thus, improved orders suggest confidence among American consumers with respect to their future financial security. The preliminary February print is expected to show a drop of -1.2% over the prior month after the 0.3% increase in February.

The data may dent the rebound in US growth expectations seen in recent weeks. Based on the data received thus far about Q1’19, the Atlanta Fed GDPNow forecast is looking for growth at 2.1% after hitting a low of 0.2% in the second week of March. The next update to the Q1’19 forecast will be released after Tuesday’s US economic data.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

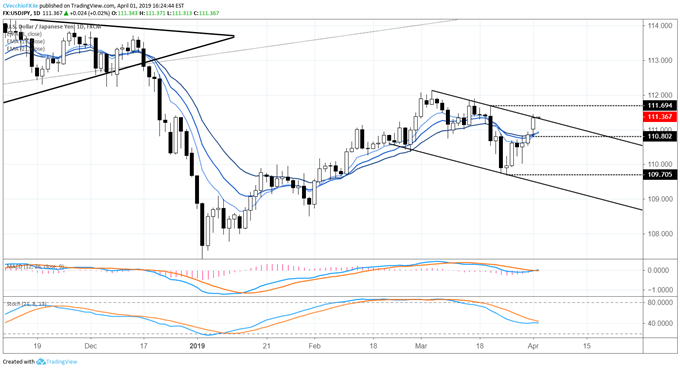

USDJPY Price Chart: Daily Timeframe (December 2018 to April 2019)

The break of the uptrend from the post-Yen flash crash low found little follow through to the downside last week, bottoming out on March 25 at 109.71. Since then, price action has been constructive, and now the downtrend from the March swing highs is under pressure. A break higher out of the downtrend would eye the March 20 bearish outside engulfing bar high at 111.69; a break down through the low at 110.80, established by the gap open at the start of the week, would suggest losses could accelerate back towards the March low.

Read more: Top 5 Events: April RBA Meeting & AUDUSD Price Outlook

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX