Talking Points:

- Tuesday: Fed’s Yellen testifies in front of Congress; BoC’s Poloz speaks in Ontario.

- Thursday: UK GDP (4Q), Canadian CPI (JAN), US Durable Goods and CPI (JAN).

- Friday: US GDP (4Q).

With Greece now reviewing the terms of its four-month loan extension, and the Eurogroup set to review Greece’s own acceptance of said terms, headlines are likely to be rampant in the early part of the week. If no resolution is met, fear will start setting in as parameters of the current bailout expire on February 28, at which point the ECB could consider pulling its emergency liquidity assistance (ELA).

If we step away from Greece, the most important events of the week are arguably coming out of North America. Consumption, inflation, and general growth data are due from the United States and (to a lesser degree) Canada, buttressed by central bank commentary from the Federal Reserve and Bank of Canada alike.

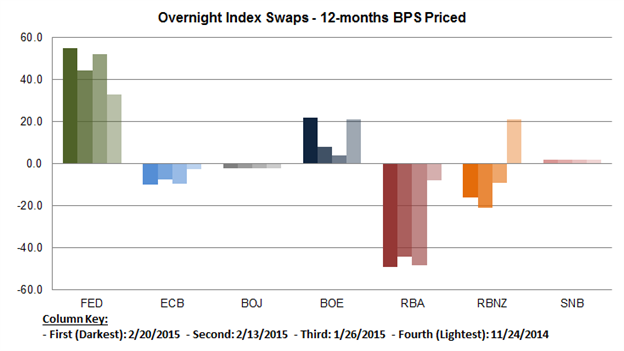

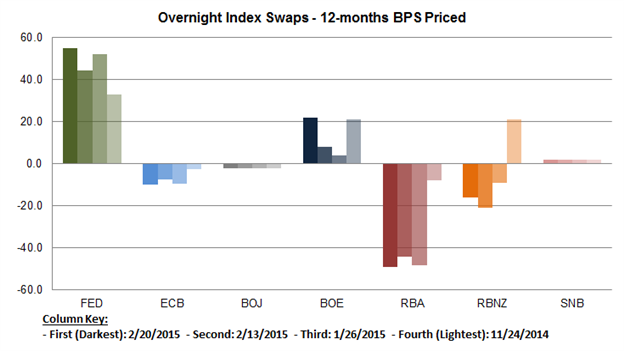

Rate Hike Probabilities / Basis-Points Expectations

See the DailyFX Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators. See all of this week’s “high” importance events.

02/24 Tuesday // 15:00 GMT: USD Fed’s Yellen speaks at Humphrey-Hawkins Testimony, CAD BoC’s Poloz speaks in Ontario

Fed Chair Janet Yellen's semi-annual Congressional appearance that is the Humphrey-Hawkins testimony will commence on Tuesday (lasting two days), offering traders a new perspective from the Fed in the wake of the strong January jobs report, which saw payrolls expand by over 1 million jobs over the past three-months alone (the January FOMC minutes release on Wednesday was for the meeting before the employment figures were reported).

Meanwhile, BoC Governor Stephen Poloz's speech on Tuesday should garner equal merit in context of the March 4 BoC policy meeting. Recent data has been quite poor - the Canadian Citi Economic Surprise Index has dropped to -48.4, the lowest level since mid-March 2014 - and another week of disappointing data and poor Canadian bank earnings could prompt further action after the surprise 25-bps cut in January.

02/26 Thursday // 09:30 GMT: GBP Gross Domestic Product (YoY) (4Q P)

The debate over when to tighten monetary policy is likely to resume as the BoE seeks to separate global deflationary pressures from the domestic inflationary ones. Previously at +2.7% annualized, any rise in GDP will add to the latter force fueling speculation of rate increases. At present economic growth swings in the balance, as inflation slows and employment and weekly earnings pick up, leading to the best real wage growth figure since early-2008 (a good reason for the BoE to take on a hawkish stance). The figure is expected to be stable at +2.7% as the trade deficit narrowed by £2.2b in the final quarter and retail sales on average improved by +5% y/y.

02/26 Thursday // 13:30 GMT: CAD Consumer Price Index (YoY) (JAN)

Having an unambiguous negative effect on the Canadian economy, falling oil prices are once again expected to drag inflation down in January. Previously at +1.5% y/y, the index is forecast to be just +0.8% in January. However, according to Deputy Governor Agathe Côté, in spite of the decrease, deflation concerns are unlikely to arise; long-term inflation expectations remain well-anchored within the bank’s +1-3% target.

02/26 Thursday // 13:30 GMT: USD Consumer Price Index (YoY) (JAN)

As the Federal Reserve enters an intense planning phase for rate increases, CPI will be scrutinized to determine whether price declines are pervasive or concentrated within the energy sector. Previously at +0.8% y/y, analysts are expecting the index to fall further to -0.1% y/y. The result, as in December, is expected to be driven by a significant drop in the energy commodities sub-index; perhaps akin to the producer price index which fell -0.8% in January, due to progressively more drastic drops in energy prices (-10.3%).

02/27 Friday // 13:30 GMT: USD Gross Domestic Product (Annualized) (4Q S)

With the US dollar increasing growing in strength, annualized GDP in the 4th quarter is expected to fall from the advanced estimate of +2.6% to +2.1% due to trade balance adjustments. With the Fed unlikely to move rates until economic growth is healthy, the job market is robust and inflation is stable, Friday’s release will no doubt weigh on FOMC members. The deceleration is likely the result of an upturn in imports (+8.9%) and a decrease in government consumption and investment (-7.5%). However, according to a Wall Street Journal survey of economists from mid-February, growth is expected to hold up at +2.7% in Q1’15.

Non-Commercials Net Futures Positioning

Read more: Is USD Consolidation Ready to End? Charts for the Week

--- Written by Christopher Vecchio, Currency Strategist and Kara Dailey, DailyFX Research

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form