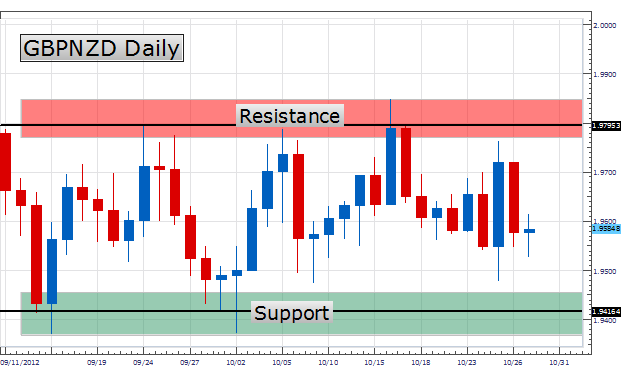

As market volatility dies down with the conclusion of the 2012 trading year, many traders begin to find more Forex pairs ranging. These periods can bring great trading opportunities for both traditional overbought and oversold traders (discussed in the October 8th edition of Chart of the Day), as well as for breakout traders. Below we can see the GBPNZD currency pair continuing to range and trading in a 482 pip range. The range is developed by identifying resistance at current highs near 1.9850 and support at a price level near 1.9368. With these areas defined we can then proceed with a trading plan to trade these pricing levels upon a breakout using OCO entry orders.

(Created by Walker England)

When it comes to trading ranges, breakout traders will look for price to either violate a standing support or resistance level. If prices break to a higher high, traders will look to buy. Conversely preferences should be given to selling the underlying currency pair if prices break to lower lows. One of the easiest ways to place both of these orders is through the use of an OCO entry order. OCO (One Cancels the Other) ordersare designed to setup two entries to enter into the market with a long position on the break of resistance of a short position with a break of support. As the name suggests, the OCO is comprised of two orders and if one order is executed the other will be cancled and no longer remain pending

Once entries outside of support and resistance levels are found, traders need to find exit points for their trade. Traders using OCO orders may choose to set their stop orders at the same price for both orders. As seen below the midpoint of the range is an excellent starting point for this value, which will be found below current resistance and above standing support. Once a stop value is decided, limits can be set using a 1:2 risk reward ratio. Using this setup traders will look for approximately the distance of the initial range in pips for setting their limit orders.

(Created by Walker England)

My preference is to trade the GBPNZD using an OCO entry order to buy above 1.9860 and sell below 1.9358. Stops can be set in the middle of the range near .9620 risking 240 pips. Minimum take profit targets should look for 480 pips profit for a clear 1:2 Risk/Reward ratio.

Alternatives include prices continuing to trade, offering further RSI market entries.

Next: How to Trade Panic (38 of 50)

Previous: Trading False Breakouts

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com . Follow me on Twitter at @WEnglandFX.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE