Talking Points:

- Primary Way of Drawing Fibs

- Taking Key Impulses on the Chart to Draw Fibs

- Looking For Confluence Price Targets

It’s easy to feel like you’ve found the Holy Grail when you’re first introduced to the Fibonacci sequence and furthermore, the Fibonacci ratios. The common Fibonacci ratios of 38.2%, 61.8% & 76.4% can help you spot a turn-around in a correction off the prior trend. However, the way you’ve likely been taught to apply Fibonacci retracements to the chart is the only way to squeeze value out of this great tool.

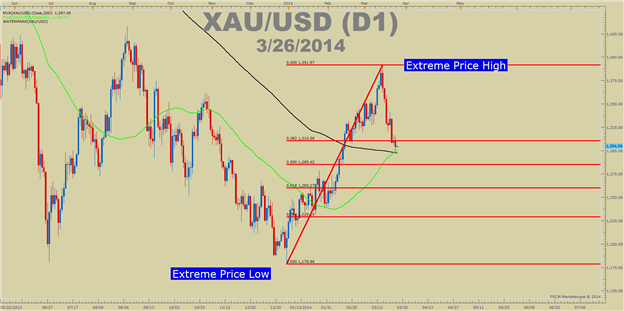

Primary Way of Drawing Fibs

Fibonacci seems so easy at first. All you have to do is pull up a chart and then draw a Fibonacci retracement from the highest high to the lowest low. However, if you’re familiar with Elliott Wave, you know that a lot of trends and corrections happen within the highest high to lowest low. Therefore, the primary way of drawing fibs (highest high to lowest low) may not be the most helpful way for trading.

Learn Forex: Traditionally, Fib Retracements Are Drawn From Low to High

Courtesy of Marketscope 2.0

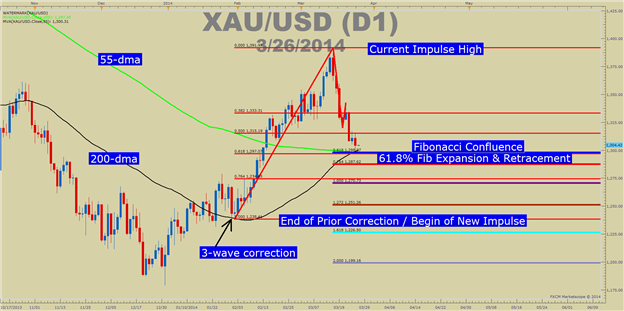

Taking Key Impulses on the Chart to Draw Fibs

The key idea to focus on here is that charts are fractal and so are trend moves. Fractal is a fancy way of saying that within one large move higher (or lower) there is many smaller bullish (bearish) trends and bearish (bullish) corrections. Fibonacci retracements are great to help you see where the correction against the trend could run out of steam so we can dissect the moves to help fine-tune some of the levels you should be focusing on.

Learn Forex: Fibonacci Retracements Applied to Individual Impulses

Courtesy of Marketscope 2.0

As you likely learned in a prior article, traders would do well do look for confluence of Fibonacci levels. Fibonacci confluence develops when a Fibonacci expansion and Fibonacci retracement come together. The chart above shows not only a combination or cluster of Fib levels around 1297 but also the 55-dma & 200-dma could act as support. One thing is for sure, a lot of traders using different tools could well be looking to buy XAUUSD from these levels.

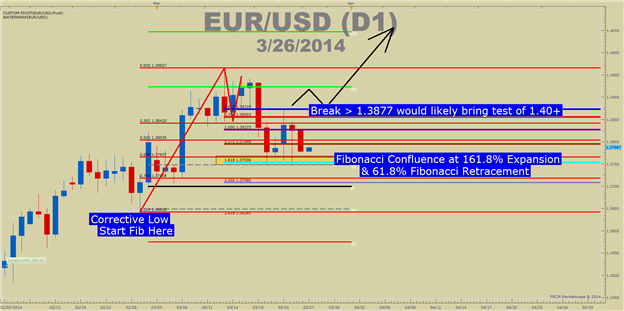

Looking For Confluence Price Targets

Confluence can help you do two things. First, if you’re trading the correction, you can look to exit the trade at strong Fibonacci confluence levels or bring your stop to break even so that you can ride out the correction or new trend with little risk. Second, if you focus only on trading in the direction of the overall trend, a key price action signal off of a Fibonacci confluence level can help you to re-enter the trend at a great level.

Learn Forex: Strong Fib Confluence on EURUSD should keep your attention

Courtesy of Marketscope 2.0

Closing Thoughts

Adjusting your Fib start and end points can be very helpful. Look for strong impulsive moves to start drawing your fibs as opposed to extreme highs and extreme lows. Regardless of your newfound knowledge, continue to manage your risk and I hope you find yourself entering into the trend earlier than before.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@dailyfx.com

To be added to Tyler’s e-mail distribution list, please click here

Tyler is available on Twitter @ForexYell

Become a Smarter Trader Today

Signup for this free “Trade like a Professional” certificate course to help you get up to speed on Forex market basics. You can master the material all while earning your completion certificate.

Register HERE to start your Forex learning now!