The 24-hour forex market: Main talking points

- The Forex Market trades 24 hours a day, five days a week.

- The greatest amount of volatility happens during market open overlap.

- Forex traders can enter and exit trades at any time during the global business day.

The 24-hour forex market is the largest market in the world and stays open five days a week 24 hours a day. It is divided in to three trading sessions: Asia, London/Europe and New York, which allows forex traders to have their pick of trading times according to their schedules.

Why does the FX market trade 24 hours a day?

The forex market is able to stay open 24 hours a day five days a week because forex trades over the counter (OTC). It does not trade at one central location. Forex trading is carried out using electronic communication networks (ECNs) in different locations around the world, mostly by big banks, and for a variety of different players.

Whereas stock trading occurs on physical exchanges, meaning that traders have to adhere to the operating hours of the exchange, forex trading happens over the counter (OTC). When one region’s business hours end, another opens which allows forex to trade continuously until the weekend. Although the forex market is open 24 hours a day five days a week, it is not always liquid. There are specific times during the day when the volume traded on the forex market is high. Traders usually take part in the forex market during these times of high liquidity.

What does 24-Hour Forex trading involve?

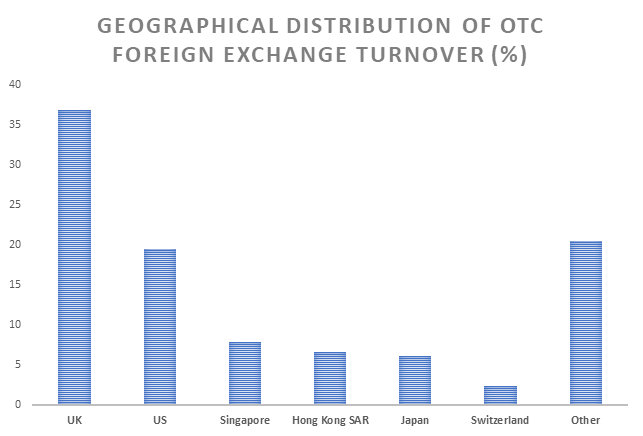

The majority of forex trading is done by financial institutions and dealers. Only an extremely small portion is done by retail traders. Traders will look to trade the forex market during the times of highest liquidity, like the New York session, London session, and Asian session because spreads will be lower and volatility could be higher.

Source: Bank of International Settlements (BIS) Triennial Report from 2016, prepared by Warren Venketas

Traders generally trade during the major forex sessions: the London session, the New York session and during the overlap. The overlap is a four-hour period of time from 8AM ET to 12PM ET when the New York session and the London session overlap leading to increased liquidity and volatility in the market.

Traders do not need to be active 24 hours a day to take advantage of the forex market. They only need to pick a time that suits them when the market is liquid enough, and stick to a trading strategy. A common strategy amongst traders during the New York and London session is a breakout strategy that allows them to take advantage of the increased volatility during the session.

1. Holidays

Because the forex market is divided into sessions they have different holidays. If America has a banking holiday then the amount of US Dollars traded will be small, but the forex market doesn’t stop. Plus, some brokers are not available on public holidays.

2. Liquidity

Trading during the main forex market sessions, like the New York and London session, offers the advantage of a reduced spread and increased volatility.

3. Employ different strategies for different sessions

Each forex market session has different characteristics and therefore a trading strategy should be adapted to suit these different conditions. During the London and New York session traders can use breakout strategies and during lower volatility sessions like the Asian session, traders can use range bound strategies.

4. Trading major currency pairs:

The major currency pairs like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF trade in high volumes which means reduced spreads and lower costs for traders.

5. Learn the basics of forex trading

We offer a free beginner guides outlining the fundamentals of forex trading, and how traders can take advantage of the 24-hour market. We also have in-depth research on the number one biggest mistake traders make, which offers useful tips for executing successful trades.

Don’t forget to stay up to date with our news and analysis on the latest currency price movements, and sign up to one of our free trading webinars for live updates.