Talking Points:

- Traders should focus on their exit plan just as much as their trade entries.

- Trendline traders could set their stop losses beyond the nearest support or resistance level and set their limits within the nearest support or resistance level.

- Setting exit prices according to support and resistance levels could tip the odds in your favor.

In last month’s trendline trading article I discussed the importance of drawing valid trendlines and entering trades based on support and resistance. While this showed an effective way to open positions, it did not explain a proper exit strategy for this trading method. That is what we will be tackling today in this article.

How Important Is Your Exit Strategy?

Many traders have a strong set of rules that they follow to enter trades, but have difficulty in selecting their exits. This is troubling because how we exit a trade should be just as important, if not more important than how a trade is entered. After all, our exits ultimately determine if our trades are profitable for us or not. So we need to make sure our exit strategy is just as logical as our entry strategy.

When we place our trades based on trendlines, we are placing them based on support and resistance levels. We are thinking the price will bounce off a trendline like it did in the past. I propose we use the same logic when setting our stops and limits.

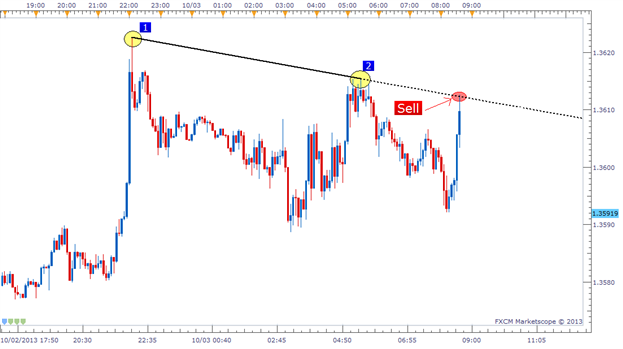

Learn Forex: Trendline Trade Example

(Created using Marketscope 2.0)

In the example above, it’s easy to see the sell entry that was given to us based on the bearish trendline. We entered right at the trendline looking for a bounce back down, but where do we want to exit? When do we call it quits if the trade goes against us? Where do we place our profit target? Let’s take a look.

Setting Stops Beyond Support/Resistance

We need to look at placing our stop somewhere above this trendline. If the resistance is broken through, we were wrong on the trade and should accept the loss quickly. It’s possible that price could return back to profitable territory after breaking this resistance, but we cannot rely on being lucky. We can only trade based on what we see.

Learn Forex: Setting Stop Loss Above Resistance

I like to set my stop 5-25 pips from the closest support/resistance level depending on the time frame I am trading. The smaller the time frame of the chart, the tighter I will place my stops. On this trade, I set my stop 5-6 pips away from my entry since that was beyond the resistance line as well as the previous swing high (Bounce #2).

Remember that when we set our Stop loss, this is also setting our monetary risk on the trade. So we also need to consider our trade side in respect to our Stop loss distance. To learn how to decide the best trade size for your account, complete this FREE Money Management video course.

Setting Limits Within Support/Resistance

Now that our stop is set, we need to focus on our profit target. For our limit placement, we have two objectives:

- Our limit’s distance needs to be further than our stop’s distance.

- Our limit needs to be placed within the closest support/resistance (by at least 5 pips).

The reason we want our limit further than our stop is because we always want to try to make more money than what we are risking on each individual trade. This is something we discuss heavily at DailyFX so I will say it again here. We want a positive risk/reward ratio.

And the reason we want our limit to be placed within the closest support/resistance level (by at least 5 pips) is for the exact same rationale we used to open this trade to begin with. We know prices have a tendency to bounce off price levels they have bounced off of before, so we want to make sure that no support/resistance is in between our entry and our limit level. In the example below you can see I placed my limit 5 pips above the swing low (potential support). This gives price a clear path to a profitable trade.

Learn Forex: Setting Limit Within Nearest Support

Trendline Strategy Complete

This trendline strategy is one that can be used universally across all currency pairs and time frames so it is definitely a worthwhile style of trading to learn. The logic behind the entry and exit rules is also something that can be tailored to other types of strategies as well. Good trading!

---Written by Rob Pasche

To contact Rob, email rpasche@dailyfx.com.

Sign up for my email list to stay up to date with my latest articles and videos.

New to Forex? Watch this introduction video (approx. 3 minutes)

Take this free 20 minute “New to FX” course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!