Talking Points

(Created using Marketscope 2.0 Charts)

Interested in Learning the Traits of a Successful Trader? Click HERE

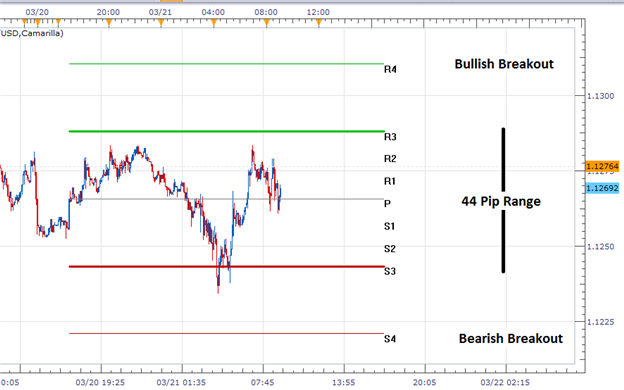

The EUR/USD has started Mondays trading, moving inside of a 44 pip trading range. In early morning, trading prices have initially bounced off support, which is found at today’s S3 camarilla pivot point at a price of 1.1244. If prices remain range bound, it opens up the EUR/USD to test values of resistance, including the R3 pivot point, which is found at a price of 1.1288.

Traders monitoring the EUR/USD for a breakout should continue to watch today’s R4 and S4 pivot points. Bullish breakouts for the day begin over the R4 pivot point, which is found at 1.1311. Conversely, bearish breakouts begin beneath the S4 pivot, which is found at a price of 1.1221. In the event that the EUR/USD trades to either of these values, it suggests that the pair may be attempting to breakout of a larger inside bar pattern. In this scenario, traders may look for a continued directional move above last Thursdays high at 1.1341 or under the low at 1.1203.

SSI (Speculative Sentiment Index) for the EUR/USD is currently reading near at -1.75. So far, this value is down significantly from last week’s reading of -1.15. As SSI continues to read negative, when taken as a contrarian signal it suggests that there may be further advances in price for the EUR/USD. Alternatively, if SSI flips to a positive reading later in the week, it may suggest a bearish retracement for the pair.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.