Talking Points

- The EUR/USD Breaks Lower on US Jobless Claims Data

- Bearish Breakouts May Target

- Bullish Reversals Begin Above 1.0750

(Created using Marketscope 2.0 Charts)

Losing Money Trading Forex? This Might Be Why.

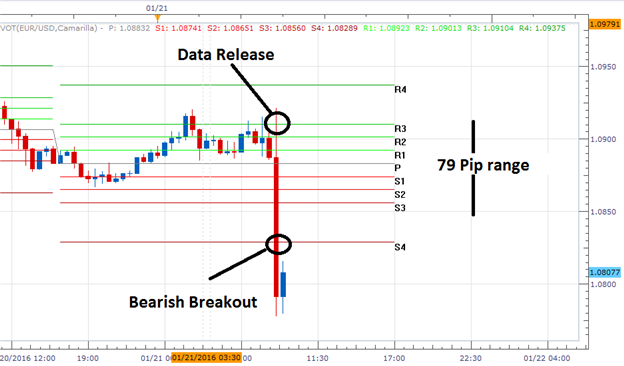

The EUR/USD has aggressively traded off of resistance this morning after USD Initial Jobless Claims were released worse than expected. The expected value for this morning event was 278k; however, the news ultimately released a figure of 293k. As seen in the graph above, this information quickly moved EUR/USD price action lower from today’s R3 pivot point, which is found at 1.0910. Currently the pair is trading below the S4 pivot point, which is found at 1.0710. A move to this point is significant, because it is potentially represents the first bearish breakout for the pair in six trading periods. In the event of further bearish momentum, breakout traders may extrapolate 1-x of today’s 79 pip trading range to place initial bearish targets near 1.0631

It should be noted that prices for the EUR/USD have been range bound this week prior to today’s breakout. In the event that prices move back above the S3 pivot found at 1.0750, it would quickly invalidate today’s early morning breakout. In this scenario, traders may look for prices to begin ranging back towards values of resistance. Today’s R3 pivot point is found at a price of 1.0829 and is currently acting as range resistance for the pair.

SSI (Speculative Sentiment Index) for the EUR/USD still remains slightly negative, reading at -1.27.While this value is not extreme, in the event of future price declines, trend traders would look for this value to again turn positive. Conversely, if SSI remains negative, it may signal a future advance for the pair.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)