Talking Points

- EURUSD opens to a false breakout

- Today’s trading range starts at 1.0707

- A breakout above 1.0796 may signal a broader reversal

EURUSD 30Minute Chart

(Created using FXCM’s Marketscope 2.0 charts)

Looking for more FX Reversals? Sign up for my email list here: SIGN UP HERE

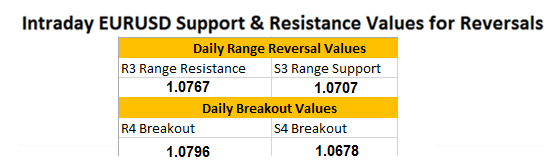

The EURUSD has opened this morning attempting to breakout towards lower lows. However, despite printing a new weekly low at 1.0675 price has failed to stay below its S4 pivot at 1.0678. Price is currently being seen moving back inside of its pivot range, starting at the S3 Camarilla pivot found at 1.0707. If price remains supported at this value, it may suggest a price bounce from this point towards values of resistance. Currently todays R3 pivot sits at 1.0767, completing todays 60 pip range.

In the event that price trades back below its S4 pivot, this would open the possibility of another daily close lower for the week. However, a reversal through today’s trading range and a breakout above the R4 pivot at 1.0796 would suggest a reversal back in the direction of the EURUSDs previous short term trend.

Then, to practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your day trading techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email instructor@dailyfx.com.

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)