Talking Points

- GBPUSD Opens in a 86 Pip Range

- Range Resistance Sits at 1.6128

- Range Reversals Triggered Under 1.5999

GBPUSD 2Hour Chart

(Created using FXCM’s Marketscope 2.0 charts)

Looking for more FX Reversals? Sign up for my email list here: SIGN UP HERE

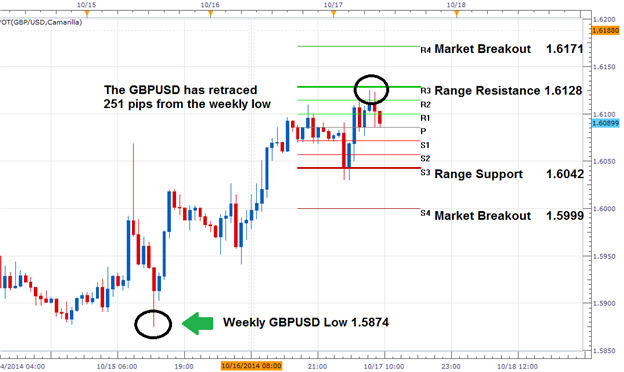

The GBPUSD opened the week sharply lower, but since Wednesday’s low of 1.5874 the pair has rebounded as much as 251 pips. However, at the open of today’s U.S. trading session, the pair paused its advance to trade inside of the marked trading range seen above. Currently price support is found at the S3 pivot at a price of 1.6042. Range resistance is found at 1.6128 completing today’s 86 pip trading range. Price has already traversed the range once this morning, and reversal traders will watch to see if price stays supported above the S3 Camarilla pivot.

In the event of a price breakout, traders will look to see if momentum is headed to a lower low, or higher high. A break above the R4 pivot at 1.6171 would give credibility to a longer term bull reversal. If price drops back below the S4 pivot at 1.5999, this would suggest that the current retracement has concluded with price heading back in the direction of the daily trend. If either breakout scenario develops, traders should look to conclude any range bound opportunities while looking to trade with the markets new chosen direction.

Suggested Reading: Trading Intraday Market Reversals

Practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your day trading techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email instructor@dailyfx.com.

Contact and Follow Walker on Twitter @WEnglandFX.