Talking Points

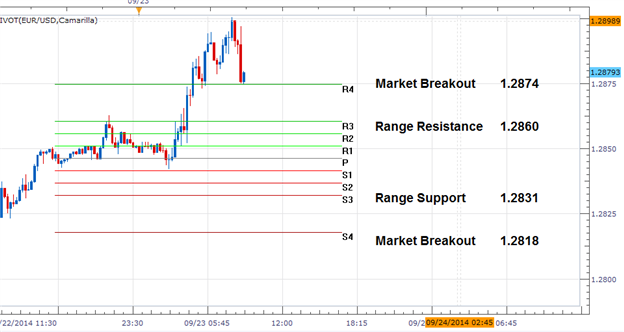

- EURUSD Breaks Resistance

- Breakout Signaled Above 1.2874

- Bearish Reversal Signaled Under 1.2860

EURUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

Suggested Reading: Trading Intraday Market Reversals

The EURUSD has opened with a breakout towards higher highs in early London trading, with the release of PMI data. Data for the high importance event on the economic calendar released better than expected, pushing the EURUSD over the R4 line of resistance at 1.2874. While price initially surged, momentum has waned pulling the EURUSD back to the previous line of resistance. As long as price stays above this value, it would be a strong signal of continued momentum allowing traders to place orders to buy the EURUSD.

As price with any breakout, there is always the potential for a price reversal. In the event of a false breakout, traders would first look for price to move back into range resistance located at the R3 pivot at a price of 1.2860. Once price has moved back into the trading range, reversal traders can look for price to potentially traverse the current 29 pip range back to support found at 1.2831. It should also be noted that price has the potential to break towards a lower low in the direction of the daily trend below the S4 pivot at 1.2818. In either scenario, this would indicate an end of bullish momentum drawing a conclusion to the present breakout environment.

Yesterdays Update

On Monday, the USDJPY remained range bound by failing to break a new high or new low. As price traded between support and resistance, traders continued to take advantage of key reversal values. By the conclusion of trading price had again traversed the daily range, before breaking out to a new low with today’s price action. To learn more, check out Fridays FX Reversal article linked below.

FX Reversals: USDJPY Reversal Range Update

Then, to practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your day trading techniques while tracking the market in real time.

Click HERE to Register Now asdf

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.