Talking Points

- USDCHF is Current Range Bound

- Range Resistance Sits at .9196

- Market Breakout Signaled Below .9176

USDCHF 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

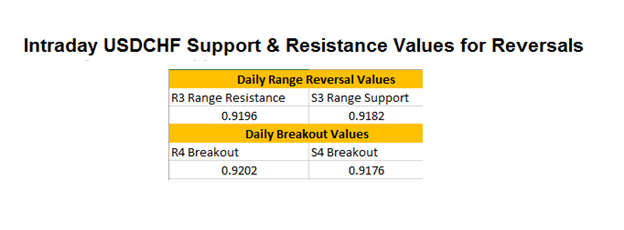

The USDCHF has failed to break lower, after early trading has moved the pair off of resistance and towards key values of support. At present, price can be considered range bound as it travels between the R3 and S3 camarilla pivot. Range resistance is currently found at the R3 pivot at .9196. While support is found at the S3 pivot at .9182. The distance between these two points has created the 14 pip rage, which has so far defined USDCHF trading. Range reversal traders will look for these values to hold providing future trading opportunities in the absences of a breakout.

Day traders should always be aware of the possibility of a market breakout. Price moving through either support or resistance would signal an end to ranging markets. A move below the S4 camarilla pivot would indicate the market is attempting to break to a lower low, under the S4 pivot at .9176. Conversely a break above R4 resistance at .9202 would signal new upward momentum on the creation of a new high. In either breakout scenario, traders may select to end any range based positions, while looking to take orders with the markets influenced direction.

Are you unfamiliar with camarilla pivots and trading intraday market reversals? Feel free to catch up, on the latest information using the article series linked below!

FX Reversals with CCI and Cam Pivots

Trading Intraday Market Reversals

Then, to practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your scalping techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Previous Market Setups:

FX Reversals: EURCAD Moves to Range Support

FX Reversals: GBPUSD Tests Resistance on News

FX Reversals: NZDUSD Moves to Resistance

FX Reversals: GBPUSD Reversal Range Update