Talking Points

- AUDUSD Stays Range Bound

- R3 Resistance Sits at .9320

- Market Breakouts Signaled Over .9335

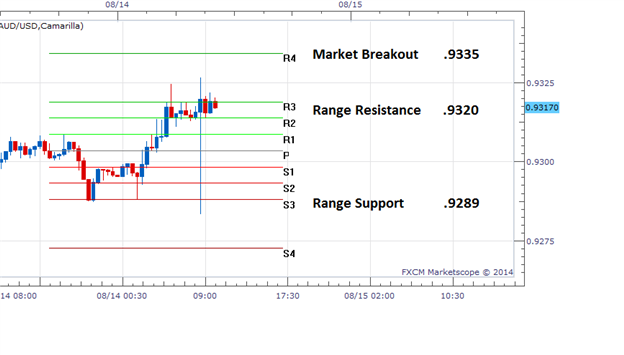

AUDUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

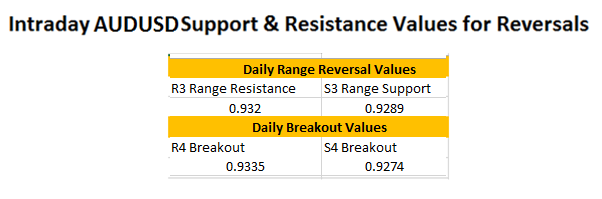

The AUDUSD has continued to move in a defined trading range overnight, as well as for the first portion of the U.S trading session. Price began moving off of S3 support after a test of the .9289 price level. Price bounced and then quickly moved to R3 range resistance at .9320. At this point, price has again moved back down to support on U.S Initial Jobless Claims and then back to resistance on continued news volatility. After three daily moves between range support and resistance, range reversal traders will look for these values to hold unless market conditions change.

Traders should always be mindful of the potential for a market breakout. A move above the R4 camarilla pivot would indicate the market is attempting to break to a higher high. Conversely, a break below S4 support would signal a strong move on US Dollar strength taking the AUDUSD pair towards new lows. In either scenario, a breakout would signal an end to ranging conditions and traders should react appropriately.

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Previous Market Setups:

FX Reversals: AUDUSD Morning Breakout

FX Reversals: USDCAD Morning Breakout Update

FX Reversals: USDCAD Tests Support