Talking Points

- According to Tony Crabbel, narrow range breakouts lead to resumption of the major trend

- Narrow Range breakouts can provide good risk to reward setups that are easy to identify

- GBP has been one of the strongest G-10 currencies and the uptrend is likely to continue

What is a Narrow Range Breakout?

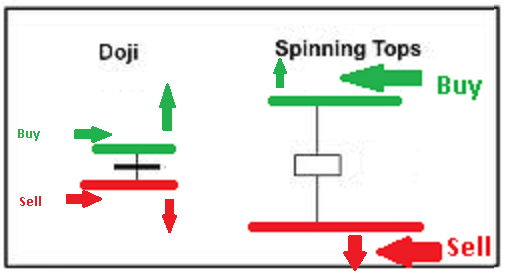

Tony Crabbel is credited with first writing about Narrow range breakout patterns in his now out-of-print book, “Day Trading with Short Term Price Patterns & Opening Range Breakout” in 1990 some 12 years before Mark Fisher’s Logical trader book which also talks about the opening range breakout. The Narrow Range breakout patterns included the doji and spinning top Japanese candlestick patterns as these candles have small bodies illustrating the small trading range.

Forex traders can look for a breakout to the upside when prices move above the wick high of spinning top or doji candlestick pattern. A break to the downside below the low the narrow range candle signals a sell.

The Forex narrow range breakout trade is based on the typical price behavior that moves from periods of low volatility to periods of high volatility. Imagine price as a giant spring that can be compressed to a very compact and small size then when the spring is released, it expands to many times its original compressed size.

As traders, we look for these compressions as they signal that a big move is around the corner. It allows traders to predefine their risk in the trade and to also calculate possible price objectives. In addition we would look to trade these breakouts in the direction of the dominant trend.

What this means is that if the daily trend is up then we would only take topside breakouts above a narrow range candle’s previous high. In addition we would ignore sell signal. Similarly, if the daily trend is down, then we would ignore upside narrow range breakouts.

On the other hand, if the daily trend is ranging in a sideways consolidation, then either upside or downside breaks can be traded.

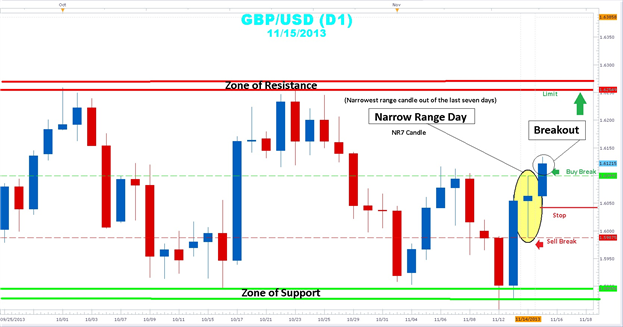

Learn Forex: GBPUSD Narrow Range Breakout Setup

(Created using FXCM’s Marketscope 2.0 charts)

Trading Example

The current trading setup shows a GBPUSD daily chart with a spinning top at November 14th with a high of 1.6099 and a low of 1.5987. On November 15th, a wide rage candle broke the top of the spinning top candle. Aggressive traders can buy the breakout above the previous day’s high. Next, they would place a stop 5 to 10 pips below the low of the current candle. A limit can be set just below the new level of significant resistance in the 1.6250 area.

On the other hand, more conservative traders will want to wait for the daily candle to close above the previous day’s high before entering long. A stop would be placed 5 to 10 pips below the low of the current candle. The dotted green and dotted red line mark the high and low of the range. A next day move above the high is bullish, while a next day move below the low is bearish. Since the daily trend is up we would ignore sell signals and only take buy signals as they are aligned with the trend.

In sum, traders have a great opportunity to rejoin a very strong GBPUSD uptrend using narrow range candles as a trigger. It is important to note that whipsaws and pattern failures can happen not only with this strategy but other breakout strategies. So it is important that you use stops.

---Written by Gregory McLeod Trading Instructor

To contact Gregory McLeod, email gmcleod@dailyfx.com.

To be added to Greg’s e-mail distribution list, please click here.

Follow me on Twitter @gregmcleodtradr.

This article showed you how look for a triangles to find a potential trade setup. I want to invite you to enroll in our free Trade Like a Professional Certificate Course. Sign our Guestbook to gain access to this course that will help you get up to speed on Forex market basics. You can master the material all while earning your completion certificate. Register HERE to start your Forex learning now!