Article Summary: Before placing a trade, traders should look to contain their risk. Learn the benefits of using Risk/Reward ratios for Forex.

Its inevitable that a new trader will want to dive in head first into the market, and immediately enter into their first Forex trade as quickly as possible As tempting as this may be, more often than not, traders will also forget the risk management aspect of their tading idea. Proper risk management is imparative to any trading plan, and allows us to know exactly where we whish to exit the market in the event that price turns against us. Today we will focus on the first step of risk management through better understanding Risk/Reward ratios.

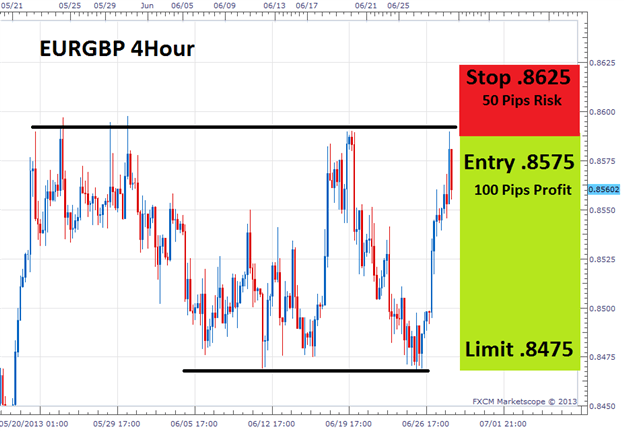

Learn Forex –EURGBP 4HR Range

(Created using FXCM’s Marketscope 2.0 charts)

So what exactly is a Risk/Reward ratio and how does it apply to Forex trading? First, a Risk/Reward ratio refers to the amount of profit we expect to gain on a position, relative to what we are risking in the event of a loss. Knowing this ratio can help traders manage risk by setting expectations for the outcome of a trade prior to entry. The key here is to find a positive ratio for your strategy. This way we increase the margin of profit when we are right, relative to the amount we lose if were wrong. Let’s look at an example of a positive Risk/Reward ratio using the EURGBP chart above.

Above the graph depicts a sample range trade on the EURGBP 4Hour chart. Traders looking to trade a trade this range would expect to enter the market off overhead resistance near .8575.When setting exits on a range trade, stops should always be set outside an indicated level of support or resistance. In this example stops are set above current resistance near .8625. In the event price breaks through the depicted range, we would be expecting to lose 50 pips on this trade. To create a 1:2 Risk/Reward ratio we would then need to make at least twice as much in profit on the position placing limit orders near support at .8475. Now that your now more familiar with Risk/Reward ratios let’s see exactly why they are so important.

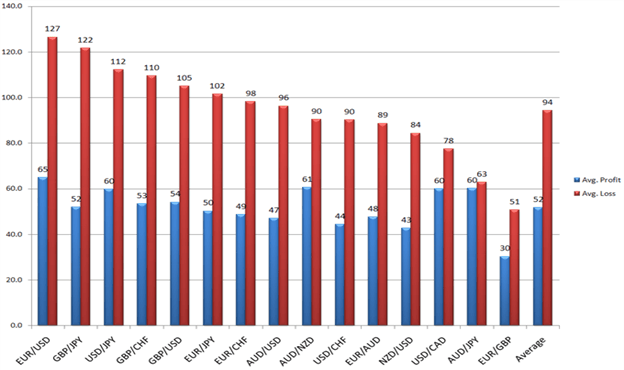

From The Number One Mistake FX Traders Make by David Rodriguez

Understanding these ratios can actually help individuals avoid the number one mistake that traders make. After sifting through over 12 million trades, FXCMs analysts were able to calculate that while most trades are closed at a profit, losses still far exceeded profits due to traders risking more on losing positions than the amount gained from a winner. This statistic shows that most traders are using a negative Risk/Reward ratio which requires a much higher winning percentage to compensate for their losses. In the graph above, we can see that the average profit on the EURGBP is only 30 pips, while the average loss is closer to 51.

The easy way to avoid this scenario is to use at minimum a 1:2 Risk/Reward ratio, as mentioned in our example. This maximizes profits on winning trades, while limiting losses when a trade moves against you. By risking 50 pips to make a reward of 100 pips in the trade above, we are effectively inverting these statistics in our favor. Meaning now, we only need to have one winning trade for any two given losers to be break even to net profitable on our trading account.