The EUR/JPY has continued to slide in price relative to its April 11th 2011 high at 123.31. Since this point the trend has moved a maximum of 2257 pips to 100.74, the October 4th low. As price continues its extended downtrend traders should begin looking for retracements to enter in with the established trend.

Fundamentally, the Japanese Yen continues to be the safe haven pair of choice, as money flees Europe in the wake of the European debt crisis. Many economists already believe that many stronger EU nations, such as Austria and Finland, will be next as a contagion effect takes place across the continent. As the situation continues to accelerate and spread, we can look for an equal reaction from the EUR/JPY.

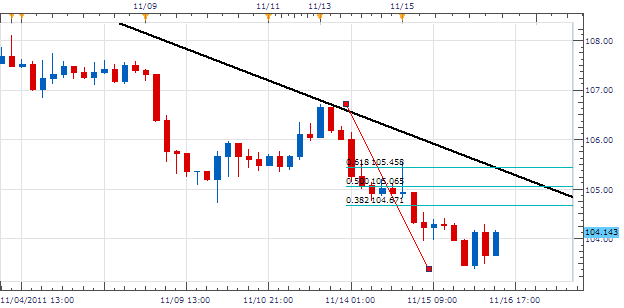

Taking Price in to a 4Hour chart we can see our trend line extrapolated by connecting our October 30th high at 111.57 with our November 13th at 106.66. One way to find entry prices against a trend line is by using Fibonacci retracements. By extrapolating this information, we will begin looking for entry points where our trend line meets our Fibonacci retracement. Using the chart below, we can look to potentially enter short with the trend, near our 50% retracement level.

My preference is to place entry orders to sell near the 50% Fib retracement level at 105.00. Stops should be above our trend line near, 105.95 Limits should look for a minimum of 200 pips on the trade for a clear 1:2 Risk/ Reward scenario.

Alternative scenarios include price breaking out above current resistance levels.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to instructor@dailyfx.com.

DailyFX provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.